The company Strategy has recently acquired 6,911 Bitcoin for a total value of 584 million dollars, bringing the total of its reserves over 500,000 BTC. With this move, the company reiterates its commitment to cryptocurrency as a long-term investment strategy to protect shareholder value. The CEO Michael Saylor continues to lead this accumulation operation, using …

Strategy increases its reserves by purchasing 584 million dollars in Bitcoin

The company Strategy has recently acquired 6,911 Bitcoin for a total value of 584 million dollars, bringing the total of its reserves over 500,000 BTC.

With this move, the company reiterates its commitment to cryptocurrency as a long-term investment strategy to protect shareholder value.

The CEO Michael Saylor continues to lead this accumulation operation, using the proceeds from the sale of shares to finance new acquisitions.

A strategic purchase by Strategy in Bitcoin to strengthen company assets

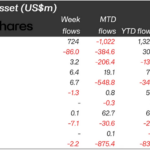

Between March 17 and 23, 2025, Strategy purchased 6,911 Bitcoin at an average price of 84,529 dollars per unit. This brings the company’s total reserve to 506,137 BTC, for a total investment of 33.7 billion dollars.

The company financed this new operation through the sale of 1.975 million ordinary shares, raising approximately 592 million dollars.

Strategy was one of the first companies to bet heavily on Bitcoin, starting its accumulation strategy in 2020.

The declared goal is to use cryptocurrency as a store of value to protect capital from inflation and global economic instability.

Strategy has represented an example for other companies that have decided to allocate part of their corporate reserves in Bitcoin. Companies like Metaplanet and Semler Scientific have followed similar strategies, albeit on a smaller scale.

The influence of Bitcoin in the international financial landscape is continuously growing, with an ever-increasing number of istituzioni, aziende e governi recognizing it as a valuable asset.

Strategy sees Bitcoin as a form of “digital gold”, with strong growth potential in the long term.

The role of Michael Saylor in the vision of Strategy

CEO Michael Saylor has been the main promoter of Strategy’s Bitcoin accumulation strategy.

A convinced supporter of cryptocurrency, he led the company in its transformation from a simple business intelligence firm to one of the largest corporate holders of BTC.

Saylor has repeatedly stated that Bitcoin represents a tool to protect corporate value from the monetary erosion caused by inflation.

The success of the strategy has been evident in the drastic increase in the value of Strategy’s shares since the first acquisitions of BTC.

The impact on the market and future prospects

The acquisition of Bitcoin by Strategy is significant for several reasons:

- – Demonstrates confidence in cryptocurrency as a store of value and long-term asset.

- – Influences the market, with possible bull effects on the price of Bitcoin.

- – Represents a signal for other companies, which might adopt similar strategies to diversify their assets.

In an economic context characterized by financial uncertainties and geopolitical instabilities, many companies are considering Bitcoin as a possible solution to preserve their capital.

Strategy, with over 500,000 BTC in its portfolio, continues to strengthen its position as one of the main corporate players in this bull space.

With Bitcoin continuously evolving as a global financial asset, it remains to be seen whether other entities will follow Strategy’s example, further driving the adoption of the cryptocurrency at the institutional level.

Finley Benson is a tech-savvy writer with a background in blockchain development, Finley explores the latest innovations in Web3, DeFi, and smart contract technologies. His articles blend technical depth with real-world applications.