With a jump in value from 77,000 to 111,000 dollars per Bitcoin in the second quarter of 2024, Strategy records a record profit of 10 billion dollars, marking a historic moment not only for the company, but for the entire cryptocurrency reserves sector. Why is Strategy’s profit an unprecedented case? Strategy, formerly MicroStrategy, has built …

Strategy: unprecedented quarterly record and a new $4.2 billion Bitcoin plan

With a jump in value from 77,000 to 111,000 dollars per Bitcoin in the second quarter of 2024, Strategy records a record profit of 10 billion dollars, marking a historic moment not only for the company, but for the entire cryptocurrency reserves sector.

Why is Strategy’s profit an unprecedented case?

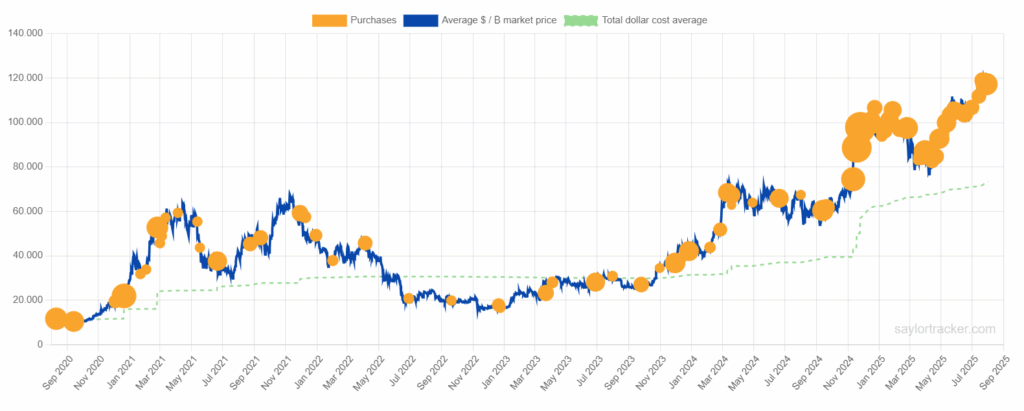

Strategy, formerly MicroStrategy, has built the largest Bitcoin holdings among all public companies, and the second quarter of 2024 marks a monumental turning point. After a loss of 5.9 billion dollars in the first quarter due to the price collapse, the sudden recovery of the asset allowed the company to record a profit of 10 billion dollars. A remarkable recovery, supported by the growth of Bitcoin’s price from 77,000 dollars to 111,000 dollars, according to CoinGecko data.

The revenue for the period, amounting to 114.5 million dollars, represents an increase of 3% compared to the same quarter of the previous year. However, the key figure remains the enormous expansion of crypto reserves, which are now worth 74 billion dollars according to the latest financial statement communicated to the SEC.

How does Strategy’s financial strategy change?

In the latest communication to the SEC, Strategy announces an innovative plan to raise 4.2 billion dollars through the issuance of new perpetual preferred shares STRC, a move introduced just ten days before the quarterly presentation. It is the first time the company uses this instrument on such a large scale in the crypto sector.

At the same time, Strategy has just invested 2.5 billion to increase its treasure: the reserves have skyrocketed from 499,000 to 597,000 BTC in just three months, with a record increase of 20% on a quarterly basis.

What are the new developments in the stock issuance policy?

“`html

In addition to the collection through preferred shares, Strategy introduces a new capital policy: it will no longer issue common shares if the value of these shares does not exceed at least 2.5 times that of the reserves in Bitcoin, unless the funds are intended for the payment of interest or dividends related to debt instruments. This choice aims to protect the value of the common shares, limiting the dilution of current shareholders and strengthening transparency towards the market.

“`

The impact on the markets: what does the title indicate?

The market reaction is immediate but cautious: in after-hours, the Strategy stock grows by 1.5%, reaching 408 dollars per share. Although it is a moderate growth compared to the boom in fundamentals, the signal for investors and analysts is clear: the company’s crypto strategy is evaluated positively, strengthened by the stability of the new governance on capital.

What consequences for the cryptocurrency reserves sector?

Strategy confirms itself as an absolute pioneer in financial innovation related to Bitcoin, not only accumulating more assets than anyone else but also experimenting with instruments such as preferred shares and corporate debt to finance large-scale purchases. This “financialization” increases the relevance of the crypto asset as a strategic corporate collateral, opening new avenues for risk management and capital raising for global big tech companies.

Consequently, the threshold of 597,000 Bitcoin held, associated with a valuation of 74 billion dollars, represents a potential benchmark for anyone looking to expand their balance sheet by leveraging cryptocurrencies.

What happens now? Prospects and risks

With Strategy’s innovative approach, questions for the future multiply: the sustainability of the model depends on the performance of Bitcoin, the response of investors to new equity structures, and the opportunities offered by further bull in the asset’s price. However, the risk related to volatility also grows, which in the past has already caused bear in deep red.

The next quarter will be decisive: between the implementation of preferential actions and the evolution of the value of crypto reserves, the future of Strategy will be in the spotlight of the entire global financial sector.

Finley Benson is a tech-savvy writer with a background in blockchain development, Finley explores the latest innovations in Web3, DeFi, and smart contract technologies. His articles blend technical depth with real-world applications.