Led by Bitcoin and Ethereum, digital asset investment products marked the twelfth straight week of positive sentiment, according to CoinShares. The investment products recorded inflows totaling $1.04 billion last week only. This figure brings the month-to-date total to $947 million. Investors continued to show strong interest in single-asset crypto products, particularly Bitcoin and Ethereum, with …

Bitcoin and Ethereum Lead as Crypto Funds Mark 12th Week of Inflows

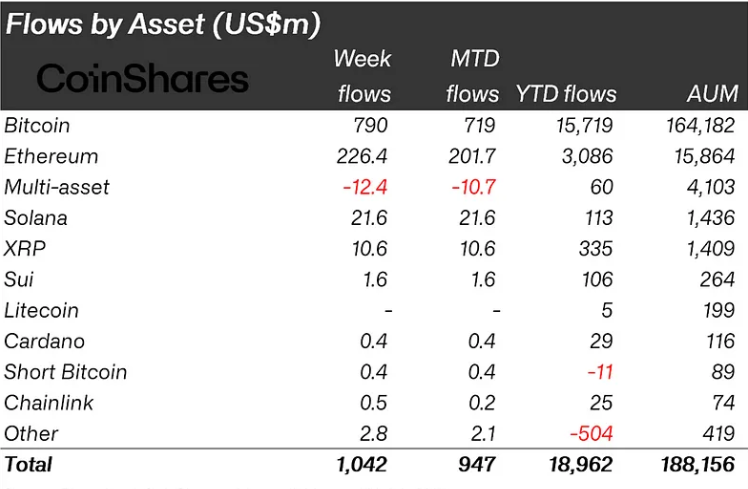

The investment products recorded inflows totaling $1.04 billion last week only. This figure brings the month-to-date total to $947 million.

Investors continued to show strong interest in single-asset crypto products, particularly Bitcoin and Ethereum, with both assets accounting for the majority of the weekly inflows. Specifically, Bitcoin led with $790 million, while Ethereum followed with $226.4 million.

Bitcoin and Ethereum Attract Majority of Capital

CoinShares data indicates that Bitcoin investment products’ flows pushed year-to-date inflows to $15.7 billion. Ethereum also saw a notable surge in investor interest, registering $226.4 million in weekly inflows, raising its year-to-date figure to $3.1 billion. Importantly, Ethereum’s average weekly inflows over the past eleven weeks have reached 1.6% of total assets under management, double Bitcoin’s 0.8% over the same period.

Meanwhile, investor appetite extended beyond the two largest digital assets. Solana recorded $21.6 million in inflows, XRP brought in $10.6 million, and Sui posted $1.6 million. Despite smaller volumes, these inflows indicate continued interest in alternative assets within the sector.

However, multi-asset products experienced net outflows of $12.4 million during the week, and $10.7 million month-to-date, suggesting a shift away from diversified funds toward targeted asset exposure.

Fund Providers Reflect Shifting Preferences

Here, Blackrock’s iShares ETFs expectedly topped the list, drawing $436 million in new capital and boosting year-to-date inflows to $17.5 billion. The funds now manage $81.4 billion in total assets. Fidelity’s Wise Origin Bitcoin Fund followed, securing $248 million during the week and nearly $500 million in year-to-date flows.

ARK 21Shares and ProShares ETFs also saw sizable inflows of $160 million and $112 million respectively. Bitwise Funds Trust received $65 million in weekly inflows, showing growing interest in smaller fund options.

In contrast, some issuers faced net redemptions. Grayscale Investments reported $46 million in weekly outflows and $1.698 billion year-to-date, though it maintains $30.8 billion in AUM. CoinShares XBT Provider registered outflows $7 million month-to-date, pushing its year-to-date total outflows to $288 million.

U.S. Leads by Region as Canada and Brazil Lag

Regionally, the United States led inflows, contributing over $1 billion of the total weekly figure. Germany followed with $38.5 million, while Switzerland added $33.7 million. These markets continued to account for the majority of new investments in digital asset products.

Meanwhile, Canada and Brazil showed contrasting sentiment. Canada posted $29.3 million in outflows, and Brazil followed with $9.7 million in redemptions.

Gabrielle Desailly a former investment strategist, Gabrielle covers the intersection of cryptocurrency and global finance. She specializes in regulatory developments, market sentiment, and how digital assets reshape economies.