Futures interest in Bitcoin, the largest cryptocurrency by market cap, has rebounded considerably, with Ethereum and Solana derivative volumes remaining flat. While Bitcoin, Ethereum, and Solana have seen similar downward price action, interest in the assets has diverged. For perspective, BTC remains largely unchanged, while Ether and SOL have corrected 2% and 1% in the …

Bitcoin Futures Volume Has Surged 32% Since Late February to $57B: Here’s What It Means for Prices

While Bitcoin, Ethereum, and Solana have seen similar downward price action, interest in the assets has diverged. For perspective, BTC remains largely unchanged, while Ether and SOL have corrected 2% and 1% in the past seven days.

Meanwhile, data from Glassnode shows that Bitcoin’s futures volume has diverged from Ethereum and Solana’s, signaling mixed market interest. Traders have opened more leveraged positions in Bitcoin pairs compared to the earlier-mentioned assets, raising optimism about a possible price swing.

Bitcoin Futures Volume Rebound

Per the Tuesday analysis, Bitcoin futures volume has rebounded from recent lows, spurred by renewed interest in the asset. At the start of the year, the worth of futures trading activities in the Bitcoin market stood at $60 billion.

Meanwhile, increased market participation saw the volume hit its current yearly peak of $63 billion in February. However, the recent market uncertainties have reduced traders’ appetite to speculate on Bitcoin’s short-term price actions, causing a sharp fall to early $40 billion.

Now, Glassnode shared a changing narrative, as traders are back trading the asset. Notably, volume has increased by 32% from February 23 and now sit at $57 billion. Nonetheless, it remains well below December’s peak of $74 billion.

As expected, Coinglass data shows that over $18 billion of these volumes came from Binance. Bitget, OKX, and Bybit also hold significant shares, with $10.23 billion, $8.37 billion, and $7.18 billion, respectively.

Ethereum and Solana Remains Flat

Meanwhile, futures volume for Ethereum and Solana has remained flat despite Bitcoin’s growing trader interest. For perspective, Ethereum’s derivative volume opened the year at $32 billion and reduced considerably before hitting $31 billion.

The asset’s futures volume stands at $28 billion, remaining almost unchanged recently. Moreover, it is nearly $10 billion off its peak volume of $37 billion last year as Ethereum’s price continues to falter.

Traders also feel the same about Solana, which has recently been marked with intense pessimism amid several high-profile meme coin fallouts. Futures volume stands at $8.7 billion, down 29% from its year-to-date high of $12.2 billion.

What It Means for Prices

Notably, leveraged interest in an asset is a two-edged sword, which could drive prices higher or lower depending on traders’ predominant sentiments. Increased volume equals more market liquidity, which could considerably impact Bitcoin’s prices.

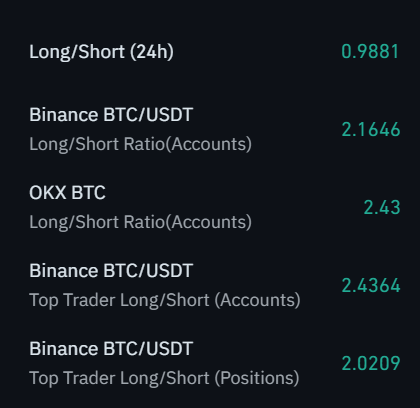

Meanwhile, Coinglass shows the long/short ratio on Bitcoin derivatives is neutral to slightly bearish, standing at 0.988. Further details per exchange reflect more bullish data, with Binance and OKX at 2.16 and 2.43, respectively.

With growing volume and more bullish bets, Bitcoin could react positively. In the meantime, the premier asset trades at $81,713, down nearly 2% in the past 24 hours.

Gabrielle Desailly a former investment strategist, Gabrielle covers the intersection of cryptocurrency and global finance. She specializes in regulatory developments, market sentiment, and how digital assets reshape economies.