Bitcoin Open Interest in the futures market has slumped 35% since the asset's all-time high, as downward pressure persists. For context, Bitcoin has faced challenges reclaiming the $90,000 psychological level, remaining stuck below it for nearly two weeks. Despite reaching an all-time high (ATH) above $109,000 in January, the asset has struggled to maintain upward …

Bitcoin Open Interest Has Dropped 35% to $37B Since ATH: What This Means for Price

For context, Bitcoin has faced challenges reclaiming the $90,000 psychological level, remaining stuck below it for nearly two weeks. Despite reaching an all-time high (ATH) above $109,000 in January, the asset has struggled to maintain upward momentum.

Instead, bearish pressure has intensified, fueling discussions over whether the current bull market has ended or if a new rally could push BTC to fresh highs. Amid this uncertainty, recent data from Glassnode reveals major shifts in market conditions.

One notable development is a sharp decline in Bitcoin open interest, which has fallen from $57 billion at Bitcoin’s ATH to $37 billion, representing a staggering 35% drop. This decline suggests a massive drop in speculative trading and hedging activity.

What the Decline in Bitcoin Open Interest Means for BTC

Bitcoin open interest represents the total value of outstanding derivative contracts. A decline of this magnitude indicates traders are either closing positions due to market uncertainty or shifting away from leveraged trading.

Glassnode noted that this crash mirrors a broader trend of decreasing on-chain liquidity, pointing to a risk-off sentiment among investors.

Additionally, an unwinding of the cash-and-carry trade, where traders profit from the price difference between spot and futures markets, suggests a weakening long-side bias.

The cash-and-carry trade is unwinding as long-side bias weakens. ETF outflows and CME futures closures suggest a shift in positioning, adding selling pressure to spot markets. ETFs, with lower liquidity than futures, may amplify short-term volatility. pic.twitter.com/aZufUkqQgT

— glassnode (@glassnode) March 20, 2025

This development, combined with ETF outflows and CME futures closures, adds downward pressure on Bitcoin’s spot price. The lower liquidity of ETFs compared to futures also means that short-term volatility could increase.

Other Key On-Chain Metrics

In addition to Bitcoin Open Interest, Glassnode highlighted another important development around the Hot Supply metric.

This metric tracks BTC holdings aged one week or less and has fallen from 5.9% of circulating supply to just 2.8%, marking a drop of over 50% in the past three months. This decline signals that fewer newly acquired coins are being traded, reducing the supply of liquid Bitcoin.

Further, exchange inflows also sync with this trend, falling from 58,600 BTC per day to 26,900 BTC, a 54% decrease. Notably, while lower inflows indicate reduced sell-side pressure, they also suggest weaker demand, as fewer coins are moving to exchanges for trading.

Bitcoin’s Current Position

Currently, Bitcoin is trading at $86,225, attempting to maintain stability above the $85,000 support level. A market commentator known as “Unknown Trader” pointed out today that Bitcoin closed above $85,000, an important level necessary to sustain upward momentum.

He also stressed that the price closed above the daily 200-day moving average, which historically signals bullish conditions.

Currently, Bitcoin is retesting the $85,000 level. If it holds, the trader expects an upward move toward the $90,500–$92,441 resistance area. However, he warns that once BTC reaches this level, a rejection and a subsequent retest of the $85,000 area could occur.

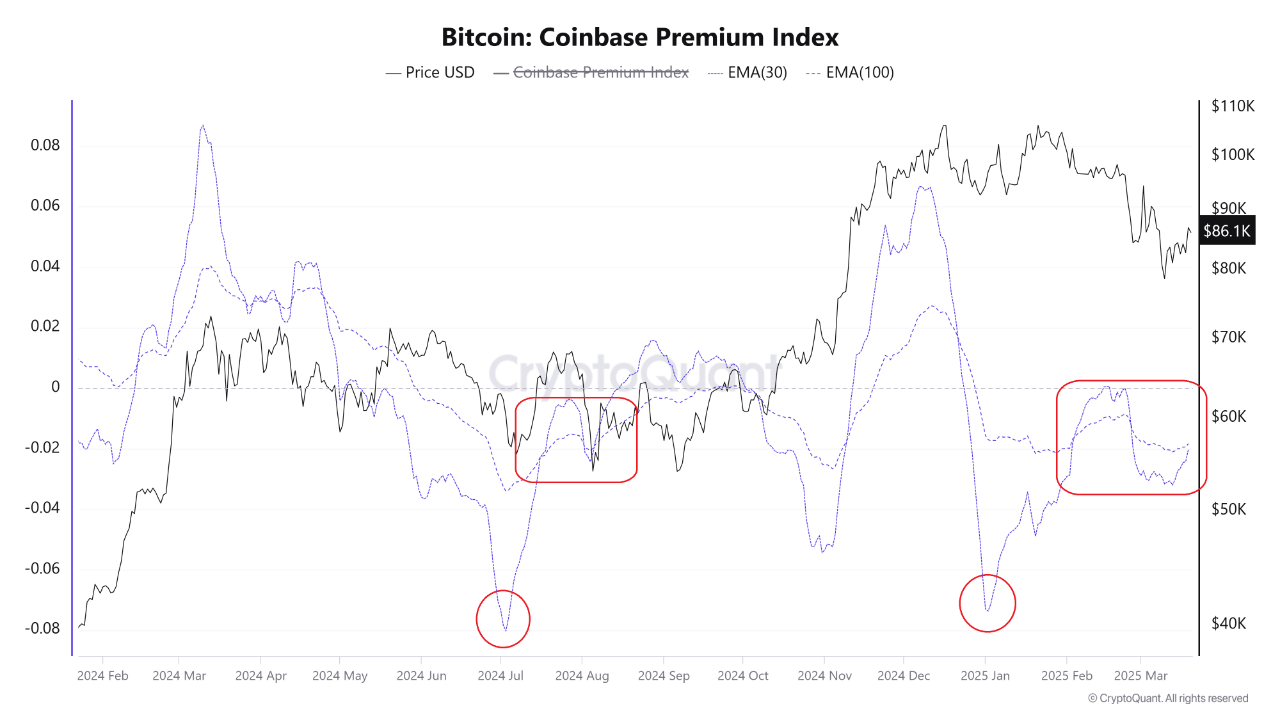

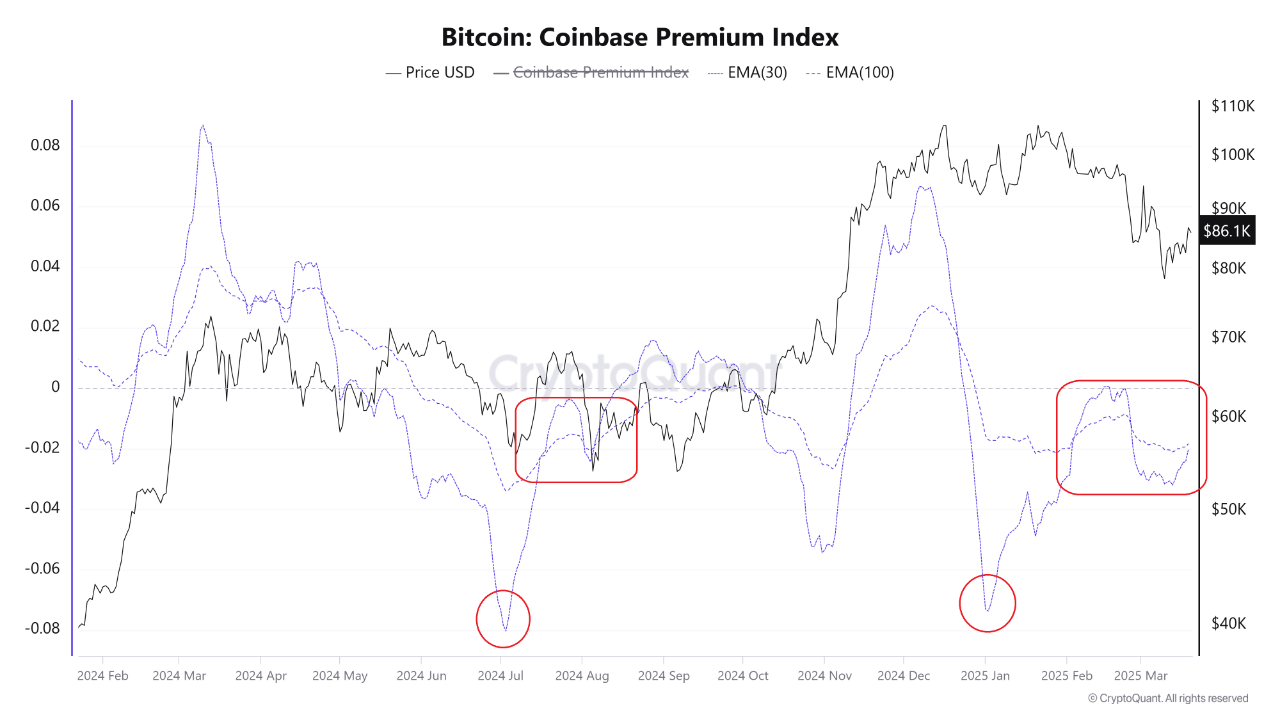

Meanwhile, CryptoQuant analyst Woominkyu pointed to a potential accumulation phase among U.S. institutional investors.

He highlighted that the 30-day EMA of the Coinbase Premium Index is attempting to cross above the 100-day EMA. Notably, similar crossovers in the past have preceded price surges, suggesting that whales and institutional players may be increasing their holdings.

Woominkyu explained that a rising Coinbase Premium Index correlates with stronger institutional buying pressure. If this trend continues, Bitcoin’s price could see further upside, extending the ongoing bull market rather than marking its end.

Gabrielle Desailly a former investment strategist, Gabrielle covers the intersection of cryptocurrency and global finance. She specializes in regulatory developments, market sentiment, and how digital assets reshape economies.