This week it seems that things have changed a bit for Bitcoin, with the price returning above 88,000 USD. The point is that a difficult phase related to the crisi delle borse USA seems to have ended, and perhaps a new one related to the indebolimento del dollaro might have begun. The flight from risk-on …

Bitcoin Price: nice reaction above 88,000 USD

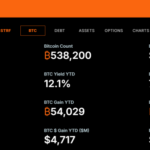

This week it seems that things have changed a bit for Bitcoin, with the price returning above 88,000 USD.

The point is that a difficult phase related to the crisi delle borse USA seems to have ended, and perhaps a new one related to the indebolimento del dollaro might have begun.

The flight from risk-on assets

Comparing the price trend of Bitcoin in recent months with the trend of the S&P500 index (the main index of the US stock markets), a change is indeed noticeable.

The drop in the price of BTC had started at the beginning of February, while that of the S&P500 shortly before the end of February.

Until last Tuesday the two trajectories have gone practically hand in hand, including the early April crash and the rebound of the following week.

Things, however, already changed at the end of last week.

This phase of decline, which began in February and is still ongoing for the US stock markets, has been characterized by a true flight of investors and speculators from risk-on assets, well represented by the remarkable rise of the price of gold that continues to reach new highs.

Yet if until last week this had also meant a loss of interest in Bitcoin, for a few days now this trend seems to have changed.

“`html

The change of trend

“`

The real change of trend occurred over the weekend, with the markets closed.

To tell the truth, the USA stock markets already closed on Friday for the long Easter weekend, and they reopened yesterday.

Thursday had been a fairly quiet day, with the S&P500 index closing the session with a very slight gain compared to Wednesday’s close.

The price of Bitcoin went from 84,400 USD on Wednesday to 84,800 USD at Thursday’s close.

It therefore seemed that it was continuing to follow a trend similar to that of the US stock markets, but already on Friday, with the American stock markets closed, the price of Bitcoin had shown some vague sign of strength.

Saturday then it had returned to 85,500 USD, indicating that in theory it seemed to have the strength to climb back up.

The decline of the dollar

The real turning point occurred yesterday, because with the reopening of the markets after the weekend, the dollar continued to weaken.

The so-called Dollar Index (DXY) is actually going through a descending phase since mid-January, as it has dropped from 110 points to below 100. It is noteworthy that such rapid movements for DXY are not common.

Many last week were expecting a rebound of the Dollar Index, after it fell to 99 points, and many still expect it. However, yesterday it fell even below 99 points, triggering a rapid rise in the price of Bitcoin above 88,000 USD.

Note that this movement occurred when the American stock exchanges had not yet opened after the weekend, and it is perhaps for this reason that the decoupling between the price trend of Bitcoin and that of the USA stock exchanges occurred.

Yesterday, in fact, while the S&P500 index closed the session with a -2.3% compared to Thursday’s close, the price of Bitcoin had jumped above 87,000 USD, which is a +3% compared to Thursday.

“`html

The future evolution

“`

Now the question is: will this decoupling last?

The key point for Bitcoin at this moment seems to be precisely the decline of the dollar, which today is indeed continuing, given that for a moment DXY even fell below 98 points.

This decline in the Dollar Index, on the other hand, is not having positive effects on the US stock markets.

In fact, since in the meantime the yield of the 10-year American government bonds is no longer falling, as it had done until the beginning of the month, the situation still seems very difficult.

Furthermore, the price of gold today for the first time in its history has reached 3,500 USD per ounce, and this clearly reveals how concerned the financial markets are about the global economic-financial situation.

The future trend of the price of Bitcoin

At this moment it is difficult to state how the price of BTC will behave in the coming days.

It is true that the weakness of the US dollar is continuing, and that this favors Bitcoin, but it is also true that after such a decline DXY could also register a small rebound.

In a situation like this, in which the flight from risk-on in the American markets persists, a potential rebound of the Dollar Index risks negatively impacting the price of BTC.

The new records of the gold price also indicate that the markets continue to be heavily concerned about how the situation is evolving, but it is not possible to completely rule out a U-turn by Donald Trump on his trade policy that could also reverse the situation in the markets.

Finley Benson is a tech-savvy writer with a background in blockchain development, Finley explores the latest innovations in Web3, DeFi, and smart contract technologies. His articles blend technical depth with real-world applications.