Analyst Mags shares strategies to maximize Bitcoin gains in the 2025 bull run as the asset moves toward a projected $180K price. Bitcoin’s recent price movement has been marked by volatility following its surge toward $99,000 on Valentine’s Day. The asset faced immediate selling pressure, leading to a retreat to $97,000, where it stabilized over …

Bitcoin Profits: Expert Reveals Easy Money Strategy for 2025

Bitcoin’s recent price movement has been marked by volatility following its surge toward $99,000 on Valentine’s Day. The asset faced immediate selling pressure, leading to a retreat to $97,000, where it stabilized over the weekend.

As the new trading week began, Bitcoin saw another downturn, with the price crashing below $93,500. Meanwhile, Bitcoin rebounded above $96,000, where it has settled till this press.

Amid these fluctuations, analyst Mags identified a silver lining based on historical performance post-halvings dubbed “Bitcoin easy money strategy.”

Bitcoin Easy Money Strategy

Mags pointed to a historical trend in Bitcoin’s halving cycles as a potential indicator for future price action. The analysis highlights a cycle-based strategy that tracks Bitcoin’s performance around halving events.

According to the pattern, Bitcoin typically experiences a pre-halving accumulation phase, where prices trade at significant lows about 500 days before the halving. Historically, investors who accumulate during this period have seen exponential gains after the halving.

Following the halving, Bitcoin enters a strong bull run, often peaking around 500 days later. At this stage, the asset reaches a macro top before undergoing a notable correction.

Based on this historical trend, Bitcoin could see a substantial rally in 2025. The analyst has identified a potential peak in Q3 or Q4 of 2025, with a projected top near $180,000, which would act as the sell zone. Other market observers, including asset manager VanEck, have echoed similar targets.

Essentially, Mags’ strategy involves entering the Bitcoin market 500 days before the halving and existing 500 days after, as the market would have reached the top by then. He urges his followers to take profit from Bitcoin at the $180 level.

#Bitcoin Easy Money Strategy 🤝

1) Buy Bitcoin 500 days Before Halving

2) Hold & Do Nothing

3) Sell 500 Days After Halving

4) Repeat pic.twitter.com/buSVBtUl29— Mags (@thescalpingpro) February 18, 2025

VanEck Echoed This Target

Notably, VanEck’s 2024 crypto outlook included projections for Bitcoin’s price trajectory in 2025. The firm expects Bitcoin to reach a cycle high of $180,000, driven by sustained bullish momentum from the market conditions at the time of their prediction.

However, VanEck anticipates a sharp correction before Bitcoin reaches its peak. The firm noted a 30% price decline could occur, coinciding with a broader altcoin market downturn of up to 60%.

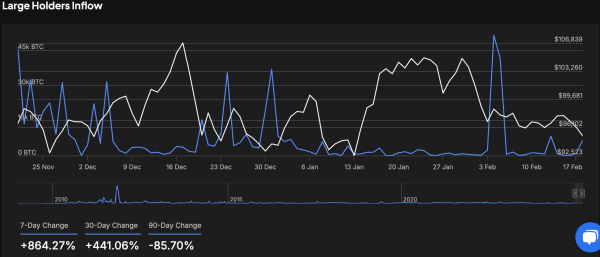

Large Holder Inflows Surge

An additional bullish indicator is the ongoing accumulation of Bitcoin among major investors. A surge in Large Holder Inflows suggests significant Bitcoin acquisitions are occurring.

The 7-day inflow change has increased by 864.27%, reflecting a sharp rise in large-scale buying activity.

Over a 30-day period, inflows have climbed by 441.06%, reinforcing the notion that whales and institutional investors continue accumulating Bitcoin. Meanwhile, the 90-day inflow change has dropped by 85.70%, suggesting a post-distribution consolidation phase.

Gabrielle Desailly a former investment strategist, Gabrielle covers the intersection of cryptocurrency and global finance. She specializes in regulatory developments, market sentiment, and how digital assets reshape economies.