A $1 billion plan to bring Bitcoin into Asian corporate treasuries: Sora Ventures presented at the Taipei Blockchain …

A dormant wallet active since November 2012 has become operational again, moving over 80 BTC out of a …

Eric Trump has said the Bitcoin “floodgates are just starting to open” as American Bitcoin launches with a …

The price of Bitcoin has been essentially stagnant for several days, awaiting the Federal Reserve’s (Fed) decisions regarding …

While Bitcoin is on a recovery path after several weeks of declining prices, some analysts believe the rally …

Today, the gold price reached a new all-time high at nearly $3,550 per ounce. Bitcoin, however, in the …

Strategy, formerly known as MicroStrategy, added over 7,700 Bitcoin in August, while SharpLink Gaming expanded its Ethereum reserves …

A New Player in the World of Hedge Funds Black Pill Capital has officially announced its debut in …

Bitcoin advocate Davinci Jeremie, who has supported the cryptocurrency since 2011, has declared that owning just one BTC …

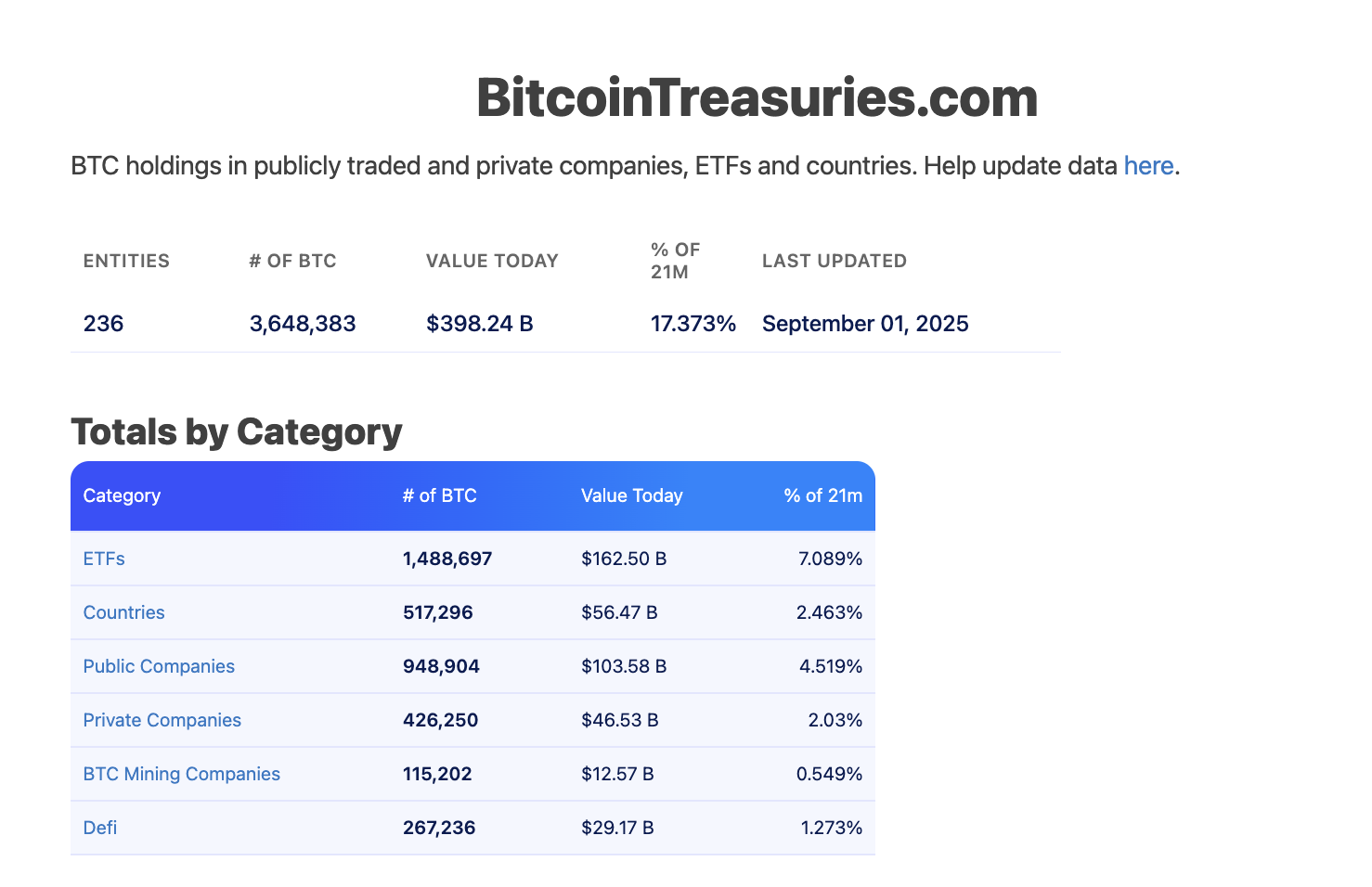

TL;DR New ATH mid-month above $124,000, closing ~ $108,000 (approximately -6/7% MoM). ETF USA: net outflows in August …

ABOUT

Every Altcoin has a story- We tell it!

Dive into latest trends, insights, and hidden gem in the altcoin universe.

Trending Now

Analyst suggests Bitcoin may consolidate before breaking key resistance, setting up for a potential new all-time high. This prediction comes at a time when the price of Bitcoin (BTC) is currently $108,094, reflecting a -2.09% price decline in the past 24 hours but a 1.31% increase over the last 7 days. Despite the short-term decline, …

On July 4th, one of the most silent and legendary bitcoin whales made an unexpected move: after 14 years of inactivity, a total of 20,000 BTC was transferred, an amount that today exceeds 2.1 billion dollars.This event, promptly detected by analysts thanks to blockchain parsing engines like btcparser.com, marks the return to the scene of …