Valentina Picozzi, the artist behind the famous statues of Satoshi Nakamoto, has revealed that Bitcoin will be part …

The Moscow Exchange has launched trading of Bitcoin futures, marking a significant step in the growing acceptance of …

The recent trend of reserve strategies in Bitcoin has led 61 publicly listed companies to collectively hold 3.2% …

Adam Back’s investment in H100 Group marks a significant step in the management of corporate treasury focused on …

Binance founder Changpeng Zhao (CZ) suggests that new Bitcoin treasury companies are making calculated, risk-based decisions like any …

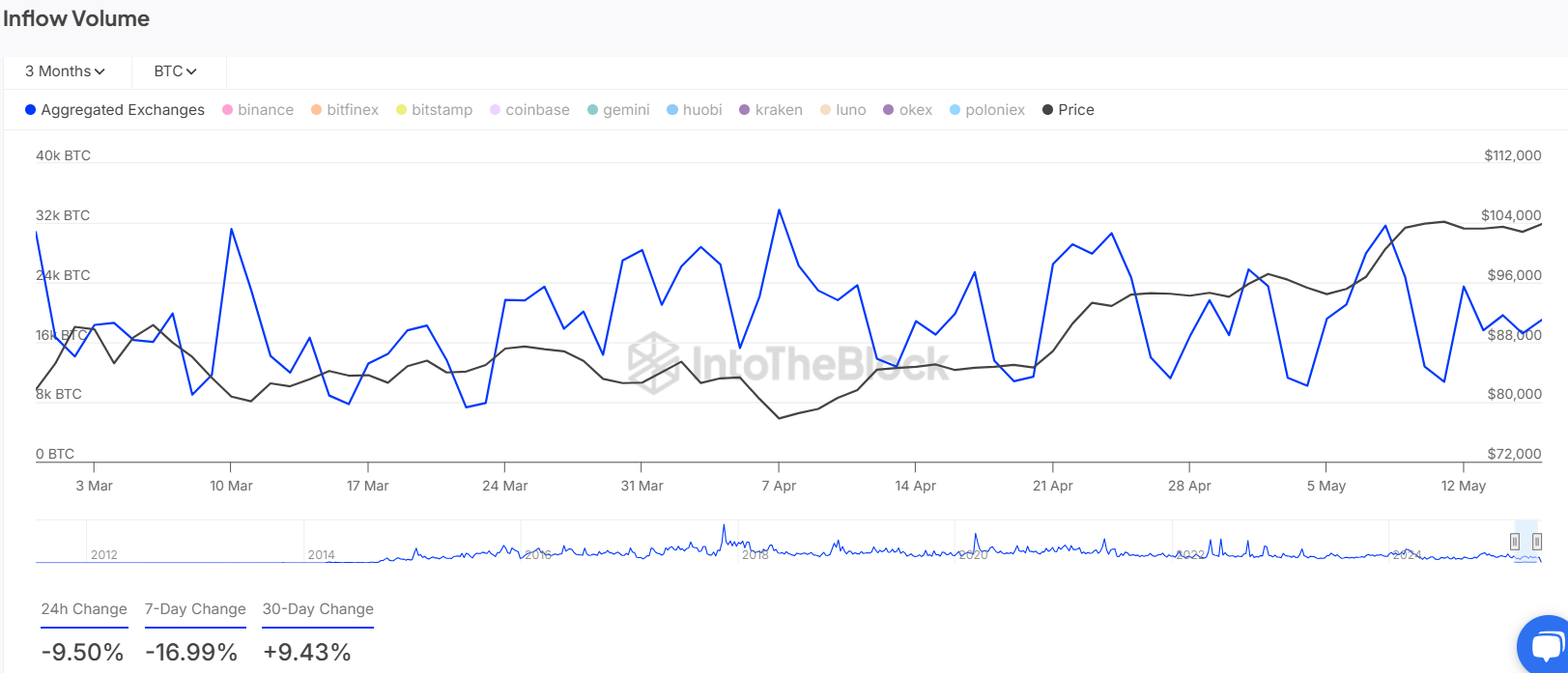

In recent days, Bitcoin has experienced significant movements with the transfer of nearly 3.9 billion dollars in BTC …

The Blockchain Group continues to accumulate Bitcoin, reaching a total treasury of 1,471 BTC as of today. The …

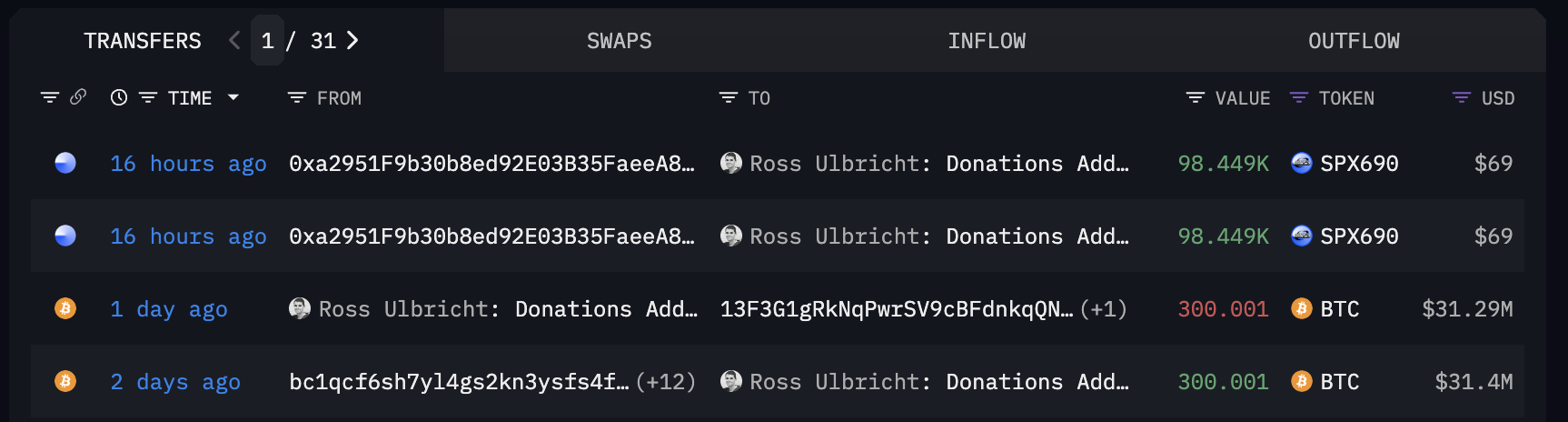

Ross Ulbricht, the founder of the infamous Silk Road marketplace, recently received a 300 Bitcoin donation into a …

One of the most well-known questions in the crypto sector is “who owns the most Bitcoin (BTC) in …

Two new Bitcoin wallets recently withdrew large amounts from Binance’s hot wallet. This news comes as Bitcoin (BTC) …

ABOUT

Every Altcoin has a story- We tell it!

Dive into latest trends, insights, and hidden gem in the altcoin universe.

Trending Now

Bitcoin is holding a bullish technical structure after completing a 5-wave impulse, according to XForce Global. The analyst now expects a short-term correction before the next leg higher. The analyst shared technical charts on X, showing Bitcoin completing a clean 5-wave impulse from the $112,000–$122,000 zone. As of this press, Bitcoin trades at $118,721, a …

Block Inc, the group founded by Jack Dorsey, is profoundly changing the standards of global fintech through the complete integration of Bitcoin into payment systems and the promotion of self-custody of cryptocurrencies. In a context of continuous evolution in the digital payments sector, Block Inc positions itself as a driver of decentralization, security, and accessibility, …