Cantor Fitzgerald Asset Management, a Wall Street giant, has announced the launch of a revolutionary investment fund that …

Bitcoin is proposed as a key to revolutionizing the passage of ships through the Panama Canal, one of …

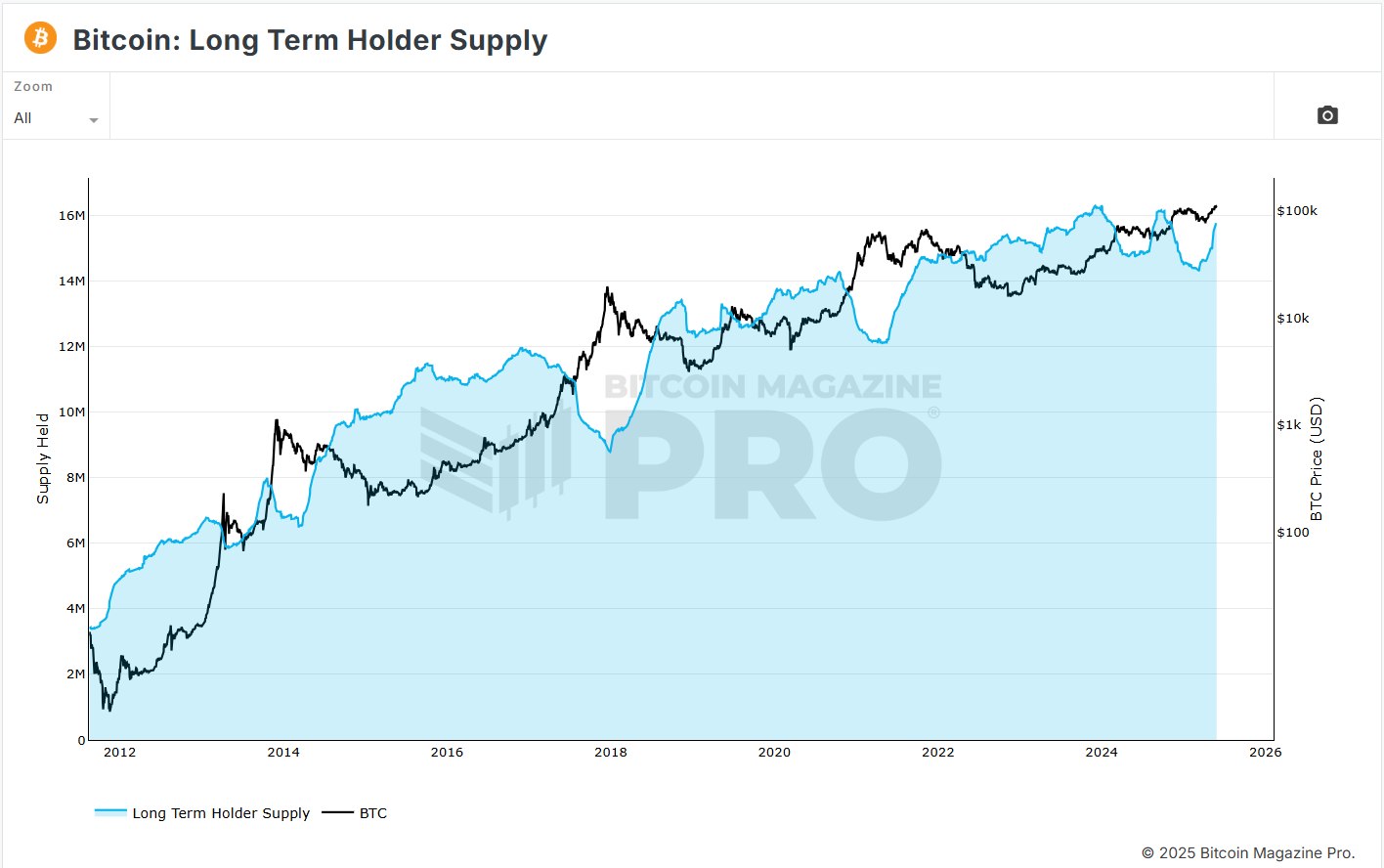

A recent report shows that long-term Bitcoin holders are not selling at current prices, and soon, there will …

At this week’s Bitcoin Vegas, the Bitcoin Rootstock Collective DAO announced its integration with Reown, the on-chain UX …

DDC Enterprise (NYSEAMERICAN: DDC) has initiated a collaboration with Hex Trust, a leading financial institution in the digital …

Kyle Chassé’s analysis shows that Bitcoin price follows global M2 money supply growth with a 90-day lag, indicating …

Trump Media and Technology Group, the media outlet of US President Donald Trump, has announced plans to raise …

KindlyMD has made an initial purchase of 21 Bitcoin for approximately 2.3 million dollars, marking a decisive step …

Last Wednesday, Google’s quantum researcher Craig Gidney published the results of a study according to which breaking Bitcoin …

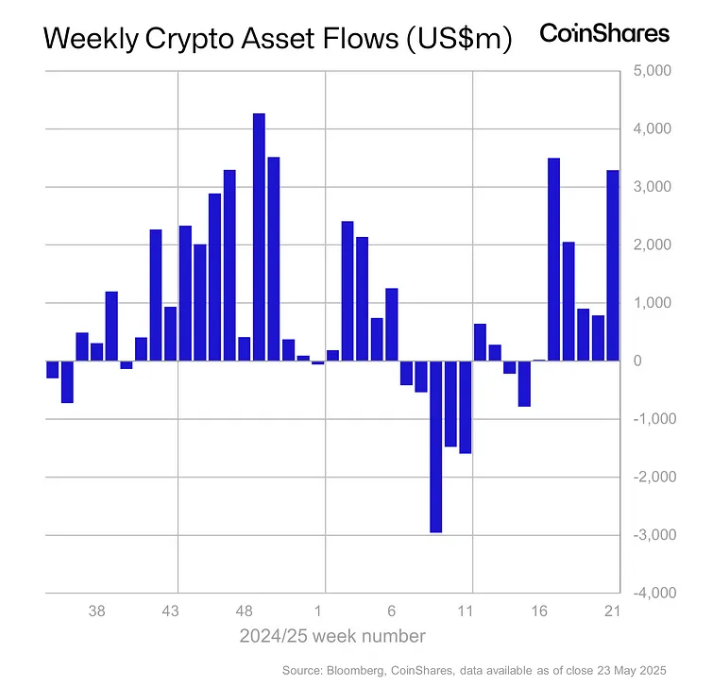

XRP saw its first weekly outflow in 80 weeks as the global crypto investment products extended their inflow …

ABOUT

Every Altcoin has a story- We tell it!

Dive into latest trends, insights, and hidden gem in the altcoin universe.

Trending Now

A long-term Bitcoin indicator tracked by analyst bitcoindata21 is close to flashing again, pointing to the possibility of another price surge. The signal is triggered whenever the market touches a yellow upward trendline that has historically marked the beginning of major rallies. This observation comes at a time of subdued sentiment in the crypto market, …

Up to 160–225 billion dollars could flow into Bitcoin in the coming years, driven by the great wealth transfer between generations. A movement of historical significance that is already impacting estate planning and how families and advisors organize digital assets. According to the data collected by our research team between 2023 and 2025, analyzing over …