Recently, Mike Novogratz, the CEO of Galaxy Digital, has sparked a wave of optimism about the future of …

David Marcus, a former skeptic-turned-Bitcoin believer, has some kind words for Bitcoin, stating that it is exactly what …

Build on Bitcoin is changing the rules of the game in layer 2 decentralization, thanks to the integration …

The historical maximum price of Bitcoin (ATH, All Time High) was recorded just ten days ago, in mid-July …

Former Brexit Minister Jacob Rees-Mogg has warned the Bank of England against undermining confidence in fiat currency, drawing …

Bitcoin continues to be the asset with the best performance denominated in Fiat since 2009, despite wars, tariffs, …

Imagine a company that transforms its treasure of Bitcoin into a powerful financial weapon, thanks to a lightning-fast …

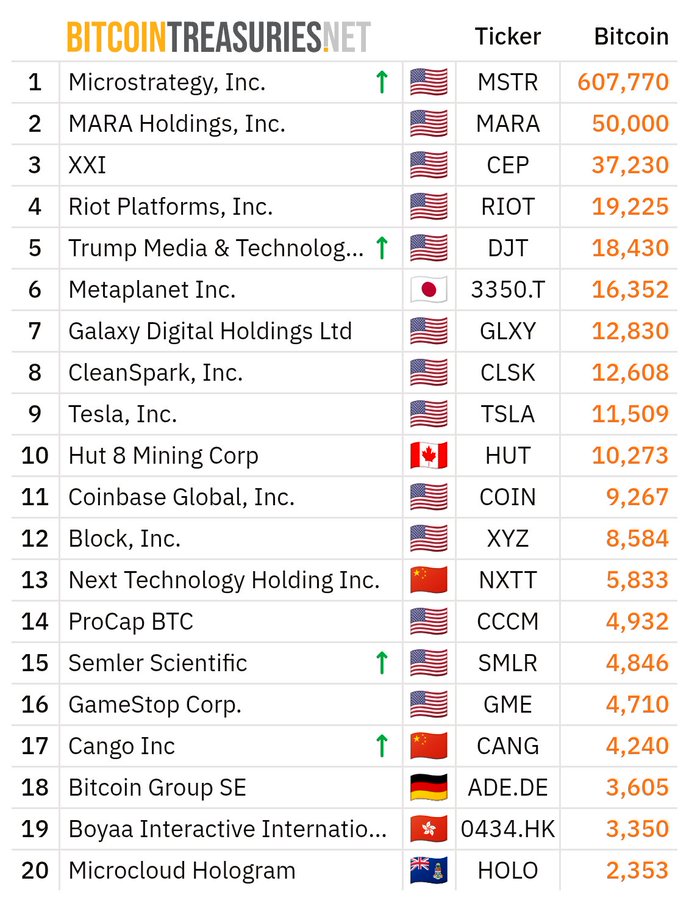

Amid the surging interest in Bitcoin among institutional players, this article highlights the top 20 largest BTC holders. …

After the rally that pushed prices close to $124,000, Bitcoin is taking a break. The 4-hour chart of …

Trump Media surprised the markets with a massive purchase of 2 billion dollars in Bitcoin, thus securing the …

ABOUT

Every Altcoin has a story- We tell it!

Dive into latest trends, insights, and hidden gem in the altcoin universe.

Trending Now

Geopolitical tensions continue to influence global markets, but their echo is much stronger in the cryptocurrency market. The report published by Binance Research on June 30, 2025, based on FRED and Nasdaq data, offers a detailed snapshot of how Bitcoin and the Nasdaq-100 have reacted to recent developments in the Middle East. The conclusion is …

Financial author Robert Kiyosaki has warned of attention-seeking “losers” who are increasingly speculating that Bitcoin will crash but hope it happens. Kiyosaki warned that these growing assertions are misleading and aim to sway speculators from reaping the rewards of buying Bitcoin. He shared these claims in a July 5 tweet as Bitcoin retraces slightly from …