Bitcoin advocate Davinci Jeremie, who has supported the cryptocurrency since 2011, has declared that owning just one BTC …

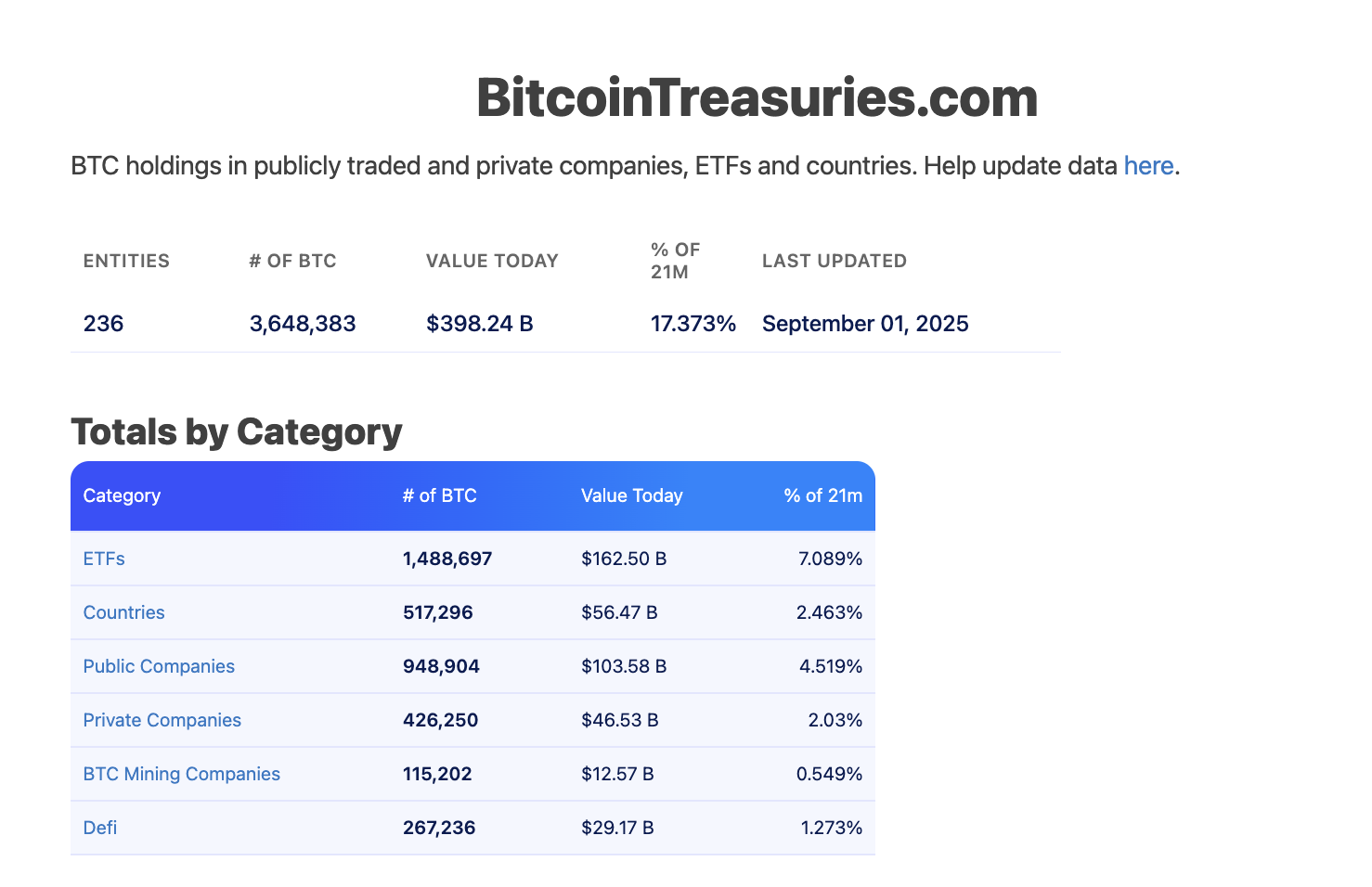

TL;DR New ATH mid-month above $124,000, closing ~ $108,000 (approximately -6/7% MoM). ETF USA: net outflows in August …

In recent days, Eric Trump, the second son of the current President of the United States, Donald Trump, …

The recent Bitcoin retracement may transcend a temporary market correction, as a top market analyst suggests early signs …

In August 2025, the Dutch company Amdax introduced AMBTS B.V., a vehicle dedicated to the accumulation of Bitcoin, …

The Smarter Web Company (SWC), a London-based company specializing in web design and digital marketing, has announced another …

Tether has announced that it will launch its stablecoin USDT natively on Bitcoin through the recently launched RGB …

Bitcoin (BTC) flows to exchanges have dropped to multi-year lows, not seen since early 2021 (May 2021), compressing …

A senior Hong Kong regulator and a legislator have pulled out of Bitcoin Asia 2025 amid the planned …

This week the price of Bitcoin has temporarily entered a new phase. This is a phase characterized by …

ABOUT

Every Altcoin has a story- We tell it!

Dive into latest trends, insights, and hidden gem in the altcoin universe.

Trending Now

Institutional appetite surged as blackrock bitcoin activity accelerated, helping drive the leading cryptocurrency back above a key psychological price level. BlackRock records massive single-day spot ETF inflow BlackRock has executed one of its largest Bitcoin purchases in recent months, with its spot ETF attracting $767 million in a single trading day. This marked the largest …

Despite the ongoing Israel-Iran war, short-term Bitcoin holders have yet to show the usual risk-off reaction associated with geopolitical tensions. Notably, rising tensions between the U.S., Israel, and Iran have rattled financial markets, pushing oil prices to fresh multi-month highs and putting pressure on risk assets.Visit Website