The Bitcoin price could reach unprecedented levels in the current market cycle, according to Changpeng Zhao (CZ), founder …

Investment products tied to cryptocurrencies registered their third consecutive week of inflows, with Bitcoin emerging as the biggest …

The institutional demand for Bitcoin through ETFs has reached an unprecedented level, creating a net imbalance with the …

According to the global macro director of Fidelity Investments, Jurrien Timmer, there might soon be a handover from …

In recent days, Bitcoin has experienced a significant breakout, fueling optimism among traders and pushing expectations towards a …

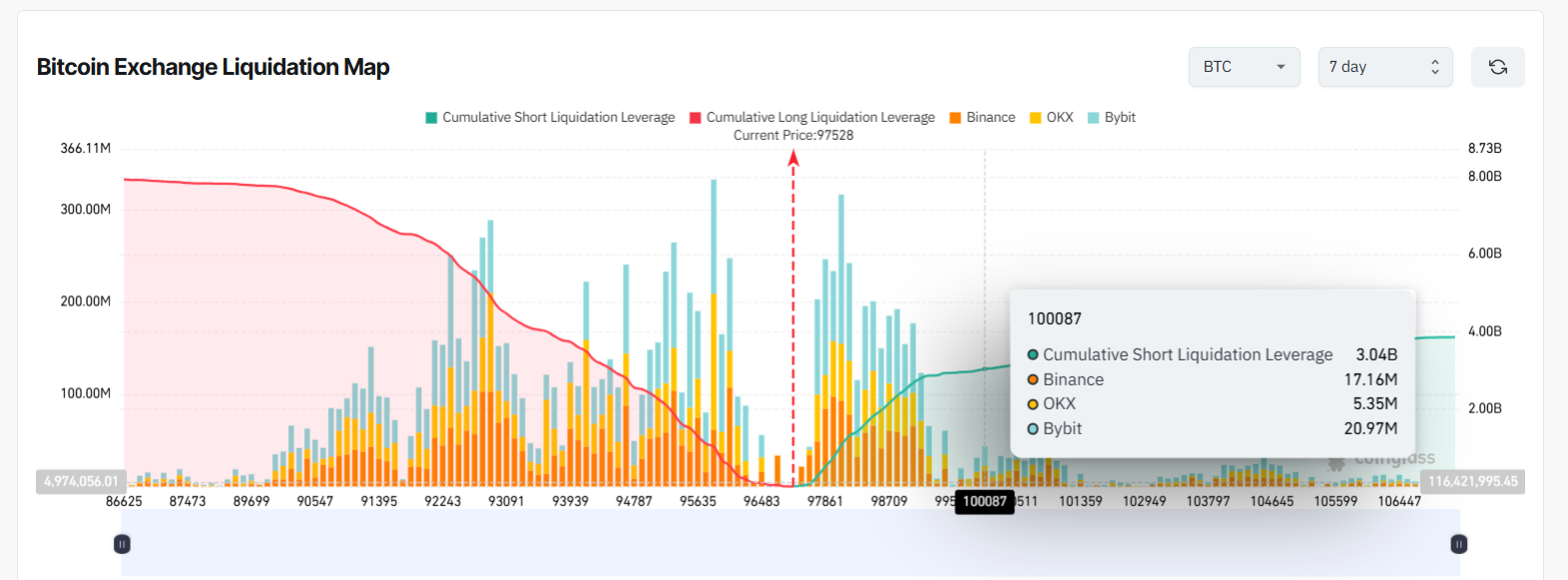

With bullish momentum now dominating the Bitcoin market, those betting against the uptrend are at risk of a …

The financial results for the first quarter of 2025 of Strategy highlight strong momentum in the cryptocurrency sector, …

Bullish developments and sustained momentum have pushed Bitcoin above $96,000 and the global cryptocurrency market cap above $3 …

Grayscale, one of the largest crypto-focused asset managers, has launched a new exchange-traded fund (ETF) called the Grayscale …

Semler Scientific has recently increased its exposure in Bitcoin by purchasing an additional 165 units for a total …

ABOUT

Every Altcoin has a story- We tell it!

Dive into latest trends, insights, and hidden gem in the altcoin universe.

Trending Now

“`html The Bitcoin derivatives market has reached record levels In the first half of 2025, the Bitcoin derivatives market reached record levels, confirming the increasingly central role of BTC as an institutional asset even in leveraged markets. According to the 2025 semi-annual report by CoinGlass, the overall open interest (OI) on Bitcoin derivatives exceeded $70 …

The first half of 2025 marked a pivotal transition in the crypto derivatives landscape, with institutional capital driving significant changes in market structure. According to CoinGlass’s H1 2025 report, the surge in demand for regulated products and robust inflows into spot ETFs have redefined the Bitcoin and Ethereum markets. CME Leads Bitcoin Futures In particular, …