A leading market commentator has weighed in on how much Bitcoin an investor would need to retire. Notably, the question of how much one needs to retire from active work has been a common topic, as many people hope they won't have to work forever. Indeed, many hope to retire early, a goal unsurprisingly shared …

Here’s How Much Bitcoin You Need To Retire Now in the US, According to This Analyst

Notably, the question of how much one needs to retire from active work has been a common topic, as many people hope they won’t have to work forever. Indeed, many hope to retire early, a goal unsurprisingly shared by several investors in the highly speculative and volatile Bitcoin and crypto markets.

So how much Bitcoin, for example, do you need to retire? One analyst has attempted to answer this question for U.S. residents.

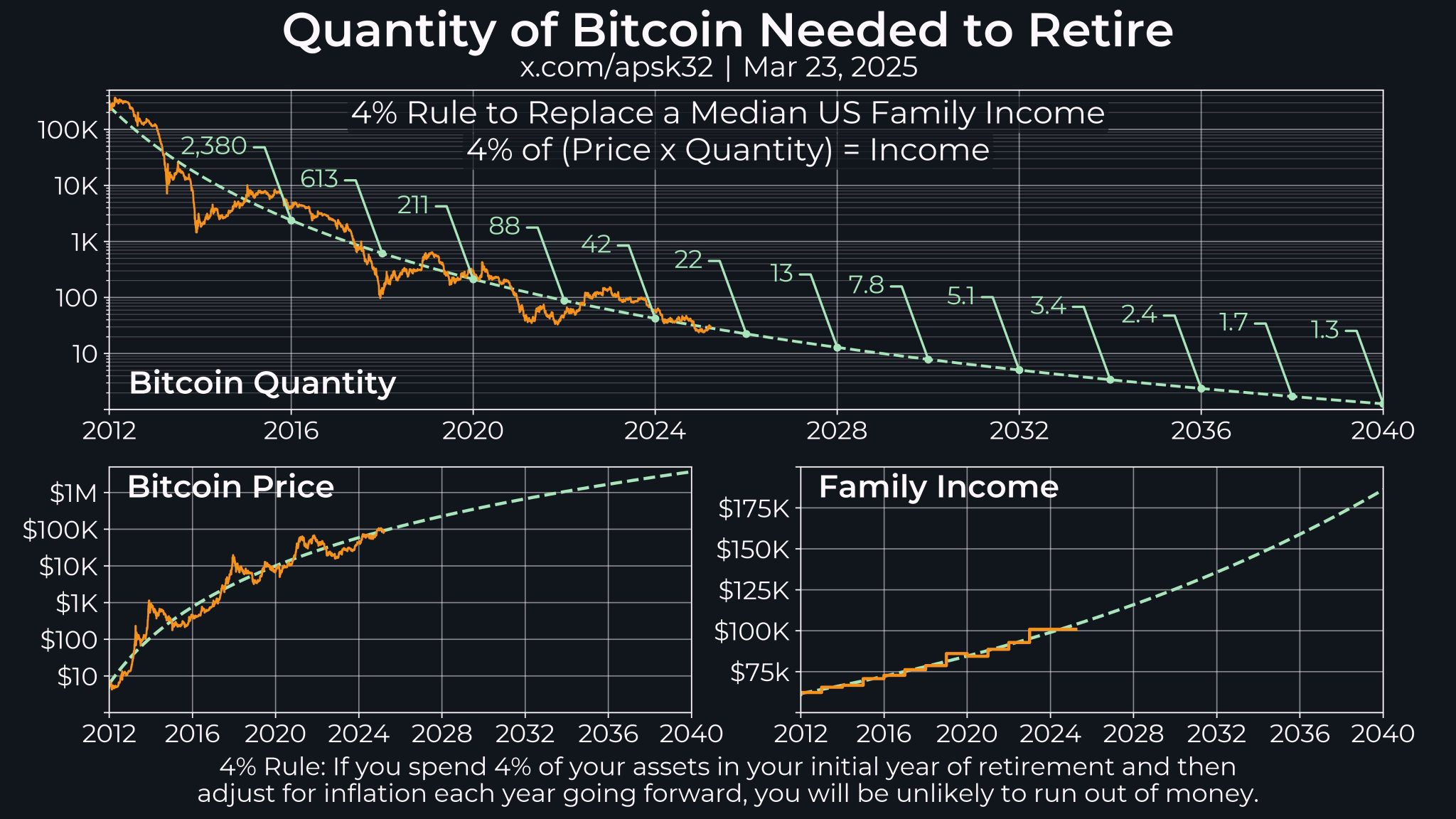

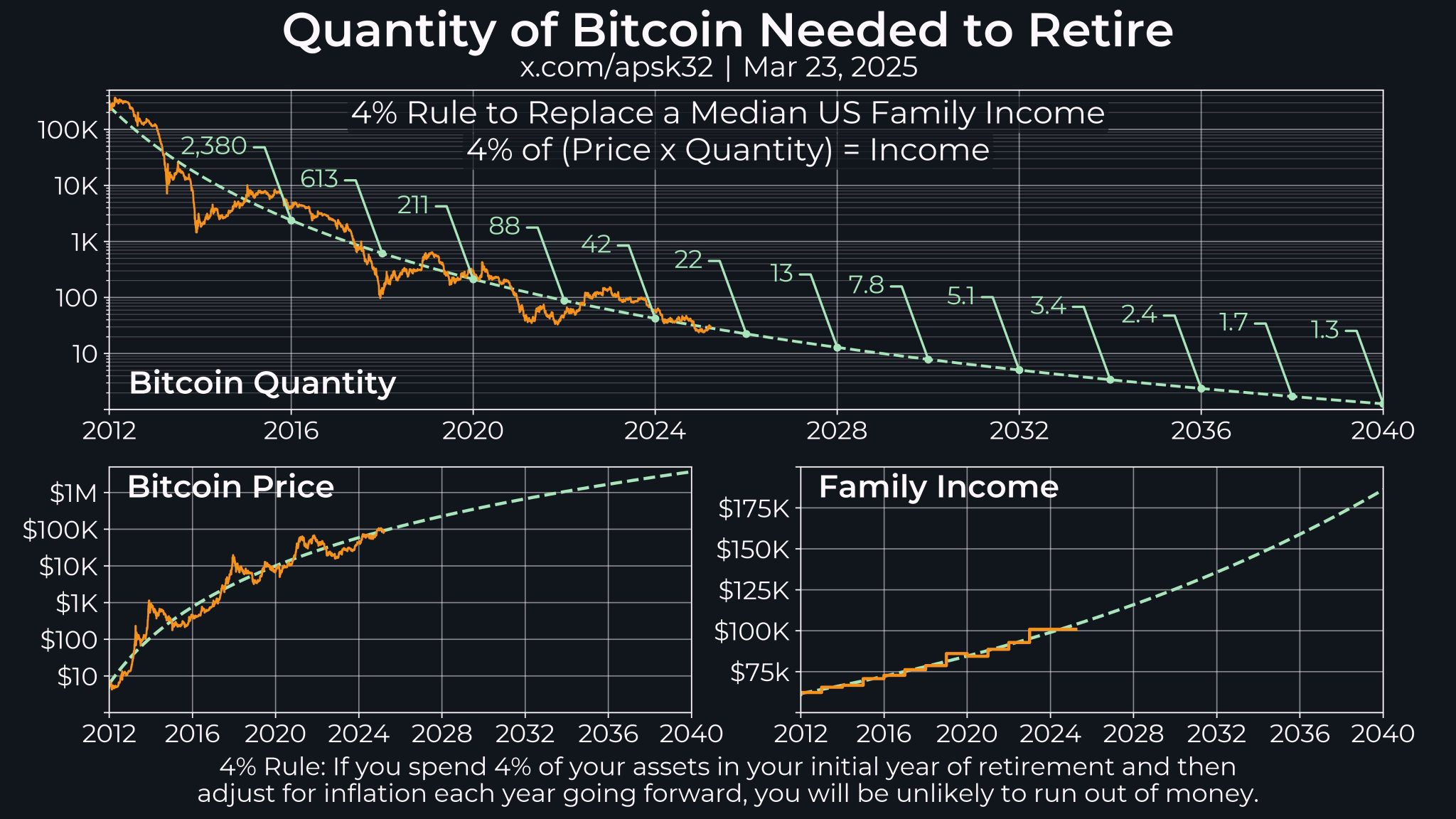

According to a chart shared by Bitcoin analyst “apsk32” on Monday, the average American now needs about 30 BTC to retire. At Bitcoin’s prevailing value, this amounts to $2.6 million.

How The Bitcoin Figure Came About

Notably, this 30 BTC estimate is based on the belief in Bitcoin’s potential to exceed $1 million per coin in the coming decade and expectations for the median family income in the years to come, factoring in inflation.

At the same time, for the model to work, users have to follow a 4% rule. The assumption is that if you spend 4% of your assets in the initial year and adjust for inflation as you go, you will be unlikely to run out of funds.

Using this rule with the 30 BTC estimate, you will need only 1.2 BTC in the first year, which is over $104,000 at the current price of about $87,000 per BTC. This drops to 1.152 BTC in your next year, and so on.

The assumption is that Bitcoin will continue to rise exponentially and that the amount of BTC needed in subsequent years will decrease as a result.

This assumption also applies to the amount of BTC needed to retire as the years go by. Beyond 2036, apsk32’s analysis suggests that less than 2 BTC will be enough.

Gabrielle Desailly a former investment strategist, Gabrielle covers the intersection of cryptocurrency and global finance. She specializes in regulatory developments, market sentiment, and how digital assets reshape economies.