In the first quarter of 2025, institutional interest in Bitcoin saw a surge in terms of holdings. Publicly traded companies have indeed strengthened their reserves in cryptocurrency, driven by strategic potential and market appreciation. Let’s see all the details in this article, Almost 700,000 Bitcoin held by publicly traded companies: the boost in holdings driven …

Institutional boom: companies increase their holdings in Bitcoin by 16% in the first quarter of 2025

In the first quarter of 2025, institutional interest in Bitcoin saw a surge in terms of holdings. Publicly traded companies have indeed strengthened their reserves in cryptocurrency, driven by strategic potential and market appreciation.

Let’s see all the details in this article,

Almost 700,000 Bitcoin held by publicly traded companies: the boost in holdings driven by long-term confidence and rising price

As mentioned, during the first three months of 2025, there was a strong growth in the accumulation of Bitcoin by publicly traded companies.

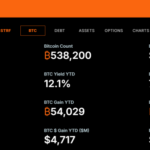

According to what was reported by Bitwise, one of the main operators in the crypto sector, the total holdings have reached 688,000 BTC, marking an increase of 16.1% compared to the previous quarter.

This growth, which is equivalent to the acquisition of over 95,000 BTC in just three months, demonstrates the expansion of institutional interest in the world’s most well-known digital asset.

In the face of a quarterly closing price of 82,445 dollars per unit, the overall value of corporate reserves reached 56.7 billion dollars, with an increase of 2.2% on a quarterly basis.

The number of companies involved has also grown significantly. The count of public enterprises holding Bitcoin has risen from 67 to 79, with twelve new entries in the first quarter of the year.

Among these new protagonists are unexpected names. For example, a company in the construction sector purchased 833 BTC in two tranches, while a video content platform invested in 188 BTC in the month of March.

Cases like these highlight a cross-cutting trend that involves different sectors, from tech to construction, including media and finance.

It is also interesting the case of an investment company that purchased a single Bitcoin in February.

Despite the modest amount, the announcement caused an almost 100% surge in the company’s stock price, demonstrating the positive psychological effect that association with Bitcoin can have on the market.

Stable price, growing confidence

Among the most active buyers stands out Metaplanet, which has increased its reserve with 319 BTC purchased at an average price of about 11.8 million yen per coin.

With this operation, the overall holdings of the Japanese company amount to 4,525 BTC, with a current value of 383.2 million dollars.

Up to now, Metaplanet has spent a total of 406 million dollars for the purchase of Bitcoin. Thus positioning itself as the tenth largest public holder in the world, just behind a well-known fintech that owns 8,485 BTC.

The market reaction was positive. The Metaplanet stock recorded a +3.71% on April 14, even though it experienced a slight correction the following day.

This dynamic confirms how operations related to cryptocurrencies are capable of significantly influencing the trend of stocks on the bull.

Despite the instability of the macroeconomic context, the price of Bitcoin showed relative stability in the month of April, remaining around 84,440 dollars on April 15.

After a temporary dip below 75,000 dollars on April 7, caused by new global tariff tensions, the cryptocurrency quickly recovered. Indicating therefore a recovery of 2.3% by mid-month.

This positive trend, accompanied by a constant accumulation by companies, suggests a growing confidence in the long-term potential of the asset, even in a climate of persistent regulatory and geopolitical uncertainty.

In parallel with the company’s expansion, the U.S. legislative framework is also experiencing an acceleration towards the adoption of Bitcoin.

According to the data collected, 47 bills related to state reserves in BTC have been presented in 26 states, of which 41 are currently active in their respective parliamentary processes.

Among the most significant initiatives is the recent approval of a “Bitcoin Bill of Rights” in an American state. This officially establishes legal protection for users and operators of digital assets.

Other states are following the example, with strategic laws under study or approval, aimed at establishing regulatory frameworks for the management of reserves in Bitcoin.

“`html

Outlook for the coming quarters

“`

The institutional adoption of Bitcoin seems destined to continue with a determined pace.

The combination of the entry of new players, the solidity of the price, and the growing regulatory support makes the landscape of 2025 particularly favorable for further acquisitions by companies.

In a world where the stability of fiat currencies is increasingly being questioned, Bitcoin is gaining ground as an alternative store of value. Thus capable of attracting not only speculative capital, but also strategic and defensive capital.

With the arrival of new financial instruments and the potential regulatory unlocking in various jurisdictions, the second quarter of 2025 could be important.

In particular, it could represent a further testing ground for the transformation of Bitcoin from a speculative asset to a pillar of global corporate reserves.

Finley Benson is a tech-savvy writer with a background in blockchain development, Finley explores the latest innovations in Web3, DeFi, and smart contract technologies. His articles blend technical depth with real-world applications.