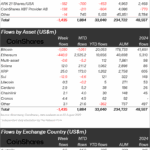

New surge in the corporate race to Bitcoin: Metaplanet Inc. has acquired 103 BTC for about $11.7 million (at an average price around $113,491 per BTC BitcoinEthereumNews), bringing the total reserves to 18,991 BTC.The entry into the FTSE Japan index expands visibility among institutional investors and index funds, with potential impacts on liquidity and cost …

Metaplanet pushes on the treasury in Bitcoin: another 103 BTC on the balance sheet and spotlight from inclusion in the FTSE Japan

New surge in the corporate race to Bitcoin: Metaplanet Inc. has acquired 103 BTC for about $11.7 million (at an average price around $113,491 per BTC BitcoinEthereumNews), bringing the total reserves to 18,991 BTC.

The entry into the FTSE Japan index expands visibility among institutional investors and index funds, with potential impacts on liquidity and cost of capital.

According to the data collected from the analysis of the statements filed with the Tokyo Stock Exchange and cross-checked with updated market sources, the purchase is consistent with the accumulation strategy declared by the company.

Analysts following ETF flows observe that inclusion in a national index can increase the liquidity of the stock and attract passive flows, effects that need to be monitored in the coming weeks.

The key numbers of the operation

- Additional purchase: 103 BTC (~$11.7 million at approximately $113,491 per BTC U.Today).

- Total reserves: 18.991 BTC.

- Indicative assessment of reserves: ~$1.95 billion (estimate obtained by multiplying the 18,991 BTC by a recent spot price of about $102,712 per BTC BitcoinEthereumNews).

In this context, the operation is part of a systematic accumulation strategy in the balance sheet, where the Bitcoin component has become a central lever of the company’s asset structure.

Why it matters: the FTSE Japan effect on price and liquidity

The inclusion in the FTSE Japan index significantly raises the visibility of Metaplanet, potentially catalyzing investment flows from passive funds and indexed trackers. In this context, it is expected:

- Greater liquidity on the stock and, consequently, a possible reduction in bid/ask spreads.

- Stable demand from ETFs and trackers that replicate the index.

- Greater transparency thanks to the reporting standards and monitoring required by international indices U.Today and the index documentation published by FTSE Russell.

An interesting aspect is the possible expansion of the investor base, which can reduce dependence on sector news. It must be said that the price sensitivity of BTC remains high.

Impact on accounts and profitability

The dynamics of Metaplanet’s earnings, especially in the upcoming periods, will be influenced by the revaluation at fair value of the holdings in Bitcoin and the natural volatility of the asset. In particular:

- The capital gains/losses generated by BTC fluctuations can affect the operating results and equity period by period.

- An increasing spot price can improve the liquidity profile and the ability to cover financial commitments.

- The concentrated exposure on a single asset results in more volatile profits, balanced by the potential for upside in the long term.

It must be said that, according to the most recent company documentation available (accessible on the official Metaplanet website), the strategy remains oriented towards the long term, with staggered purchases and careful management of the capital structure.

For more details on the accounting, refer also to the TSE filings and the official announcements published in the investor relations section of Metaplanet (</company/metaplanet>).

Context and comparison: the position of Metaplanet among corporate holders of BTC

With 18.991 BTC in reserve, Metaplanet ranks among the main corporate holders of Bitcoin globally.

Among the corporations with direct exposure to BTC, notable entities include MicroStrategy – leader in terms of reserve size – and, to a lesser extent, companies like Tesla and various publicly traded mining operators. For updated comparisons on the ranking of corporate holders, it is useful to consult aggregators and specialized databases like BitcoinTreasuries.

In this scenario, Metaplanet’s allocation falls within the high range of the corporate market exposed to the digital asset, maintaining high attention from international investors.

Risks, variables, and what to monitor

- Volatility of BTC price: directly impacts earnings, assets, and balance sheet valuations.

- Accounting rules and regulatory framework evolving in Japan and internationally: they could change the balance sheet representation and market valuation of digital assets (refer to updates from Japan Exchange Group and standard-setting bodies).

- Concentration on a single digital asset: increases the specific risk related to the volatility of the crypto market.

- Effects of index inclusion: on one hand, it can attract passive flows, on the other, it exposes the stock to periodic rebalancing.

Perspectives

The combination of growth of reserves in Bitcoin and the increased coverage by indexed investors tends to support the liquidity of the asset and keep market attention high. However, the future trajectory remains closely linked to the performance of Bitcoin, the operational discipline of purchases, and the evolution of applicable accounting standards.

Methodology and sources

- The estimate of ~$1.95 billion for the reserves is obtained by multiplying the 18,991 BTC by a recent spot price indicated in the cited sources (see BitcoinEthereumNews).

- For the verification of data related to the purchase and the consistency of reserves, please refer to the official statement of Metaplanet and the filed documents at the Tokyo Stock Exchange (TSE) (Metaplanet).

- For comparison with other corporate holders, it is possible to consult public aggregators and the bilanci of the reference companies; an aggregated reference is available on BitcoinTreasuries.

- Information on the nature and effects of index inclusions can be explored in the official documentation of FTSE Russell, provider of the FTSE Japan index.

Editorial note: data and estimates updated to August 25, 2025. At the moment, the exact date of the operation is not indicated, nor the price per BTC transacted in detail within the public statement; such information should be integrated with the primary documents (official Metaplanet/TSE statement) for accurate reconciliation. The evaluation of reserves should be updated based on the spot price on the day of consultation.

Finley Benson is a tech-savvy writer with a background in blockchain development, Finley explores the latest innovations in Web3, DeFi, and smart contract technologies. His articles blend technical depth with real-world applications.