With bullish momentum now dominating the Bitcoin market, those betting against the uptrend are at risk of a historic liquidation. At press time, Bitcoin has returned to the $97K level after briefly dipping to $96K earlier today. Meanwhile, the rally to $97,500 is setting the stage for a potential liquidation cascade. Over $3 billion in …

Over $3B in Bitcoin Shorts Set for Liquidation at $100K: Details

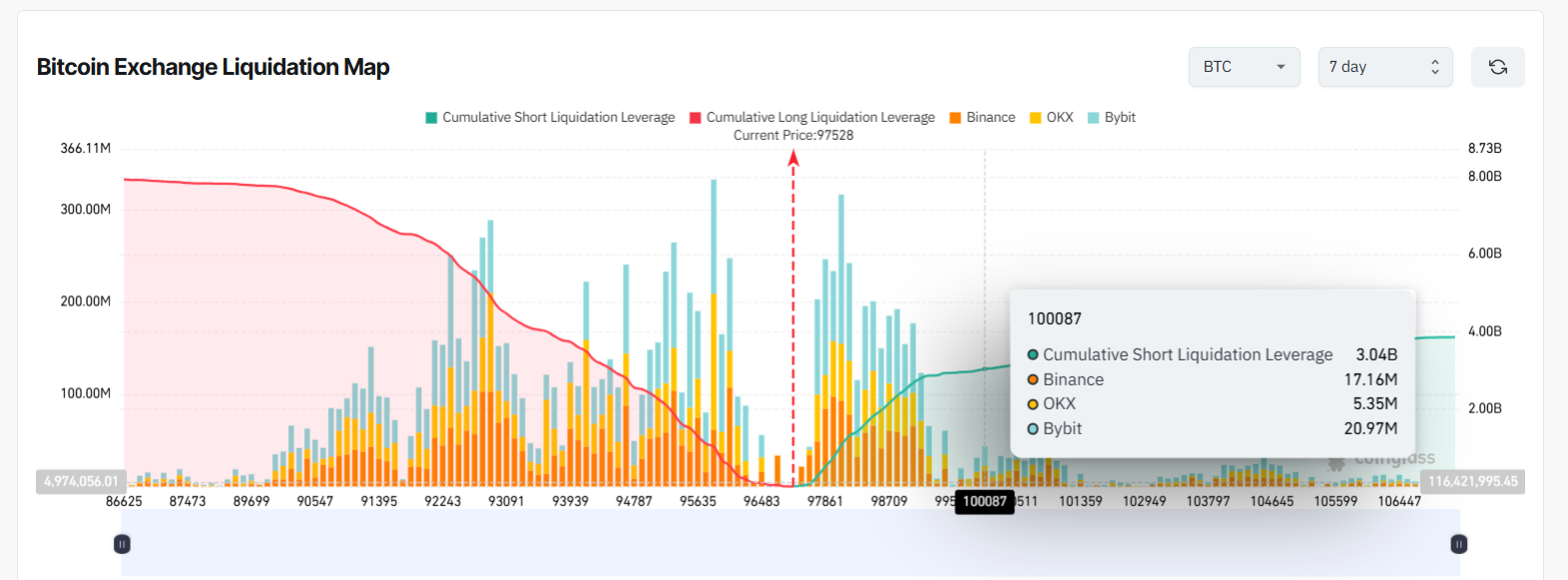

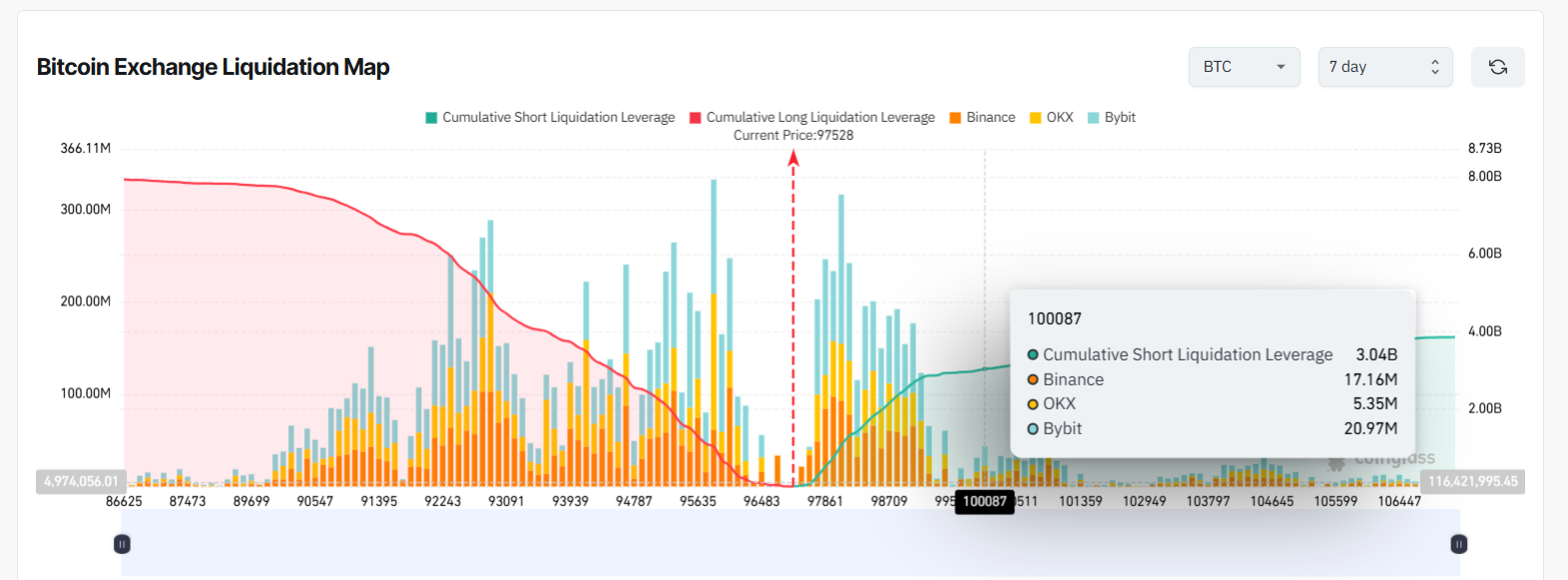

At press time, Bitcoin has returned to the $97K level after briefly dipping to $96K earlier today. Meanwhile, the rally to $97,500 is setting the stage for a potential liquidation cascade. Over $3 billion in short positions are vulnerable above the key $100,000 mark, according to data from Coinglass.

$3B Short Squeeze at $100K

The liquidation heatmap reveals a significant cluster of short positions across major exchanges, including Bybit, OKX, and Binance, concentrated between $97K and $100K. As the price climbs, cumulative short liquidation leverage is now trending toward $4 billion. This indicates that leveraged bears are increasingly exposed.

At the $100K breakout level, bears on these exchanges would face losses of around $3.04 billion. As the price continues upward, those losses become even more pronounced. Specifically, a Bitcoin move to $105K would trigger around $3.73 billion in liquidations, and at its all-time high near $109K, the total could approach $4 billion.

Meanwhile, long positions have largely been cleared out during the recent correction. The cumulative long liquidation leverage (red curve) has sharply declined, suggesting the market has reset. This leaves room for a potential upside breakout with minimal resistance from overleveraged bulls.

Notably, crypto analyst Carl Moon highlighted the setup on X, stating, “Let’s send it.” His remark highlights the growing sentiment that a short squeeze could propel BTC well beyond six figures.

Bitcoin at a Critical Resistance Point

Currently, Bitcoin is trading within one of its biggest resistance zones. Data from IntoTheBlock shows that between the $96K and $98K range, around 1.06 million addresses acquired approximately 750,800 BTC, worth about $73 billion.

This makes it Bitcoin’s largest supply zone. Once this barrier is overcome, a thinning wall of resistance will follow, particularly around the $100K level.

However, should bears overcome bulls at this juncture, Bitcoin risks dipping to the $93K and $82K regions. In these areas, strong buying pressure could reemerge.

Key levels for #Bitcoin $BTC as shown by data from @intotheblock:

• Support: $93,700 and $82,000

• Resistance: $97,600 pic.twitter.com/vmbq9yXS4R— Ali (@ali_charts) May 2, 2025

With Bitcoin flirting with new all-time highs, traders are eyeing the long-awaited $100K psychological barrier and beyond.

Prominent market watcher Peter Brandt has even floated the possibility of Bitcoin rallying to the $120,000–$150,000 range within the next four months. He believes that would be the point where a new bear market cycle could begin.

Gabrielle Desailly a former investment strategist, Gabrielle covers the intersection of cryptocurrency and global finance. She specializes in regulatory developments, market sentiment, and how digital assets reshape economies.