Imagine a company that transforms its treasure of Bitcoin into a powerful financial weapon, thanks to a lightning-fast stock market listing. This is what is happening with Bitcoin Standard Treasury Company, ready to debut on financial markets thanks to a SPAC merger. This operation could rewrite the rules of public crypto investments: a turning point …

Public Bitcoin Treasury: how the SPAC merger revolutionizes strategies and yield in the bull and bear market

Imagine a company that transforms its treasure of Bitcoin into a powerful financial weapon, thanks to a lightning-fast stock market listing. This is what is happening with Bitcoin Standard Treasury Company, ready to debut on financial markets thanks to a SPAC merger. This operation could rewrite the rules of public crypto investments: a turning point that promises transparency, innovation, and new opportunities for investors and institutional players.

Why does the “public Bitcoin treasury” now attract the attention of the entire market?

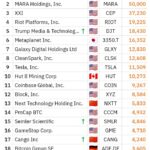

When publicly traded companies decide to hold Bitcoin as part of their reserves, every move becomes public, verifiable, and often the subject of global analysis. This phenomenon is growing: according to data from CoinGecko, public companies held over 272,000 BTC at the beginning of 2024. For investors, it means being able to participate — even indirectly — in the Bitcoin bull rally with regulated instruments and greater operational security.

SPAC and Bitcoin: just a trend or the key to a new financial ecosystem?

Here’s what changes with the listing through SPAC:

- Faster process compared to traditional IPOs

- More liquidity and visibility immediately, with the ability to raise significant capital

- Access to a team of industry experts, as demonstrated by the presence of crypto pioneers, including Adam Back

By doing so, companies like Bitcoin Standard Treasury Company can aspire to compete with giants like Strategy, opening up to new global strategies on reserves and derivative products.

Behind the scenes: how is a Bitcoin treasure managed today?

Modern management of public Bitcoin treasures no longer just means “keeping in the safe”. Key strategies include:

- Loans guaranteed in Bitcoin at variable rates, also open to institutional clients

- Crypto-backed insurance that protects both retail and corporate investors

- Diversification of income, leveraging for example selected DeFi protocols and advanced liquidity tools

All this increases stability and performance of the corporate treasury, making Bitcoin an asset increasingly central in public balance sheets.

Bitcoin as collateral: an advantage or a hidden risk?

Using Bitcoin as collateral for financial products is becoming a widespread practice. The main benefits include:

- Transparency: every transaction is easily verifiable through blockchain

- Attrattività internazionale: investors from all over the world can participate in the issuances or structured products

- Innovation in products: from insurance to loans—even crypto-backed mortgages are emerging as innovative solutions in the market

Attention, however: volatility remains a risk, and regulation is still being defined. We will discuss it in the upcoming sections!

Bitcoin yield strategies: which trends are dominating 2024?

The year 2024 marks the rise of new yield strategies on Bitcoin. The most prominent ones are:

- Institutional loans with premium rates, guaranteed by Bitcoin

- Insurance that covers custody and volatility risk

- Use of the latest layer-2 technologies such as the Lightning Network for fast and secure microtransactions

According to a report by Galaxy Research, more and more publicly traded companies are considering these avenues to monetize or balance their digital treasury.

How does the “public Bitcoin treasury” work in practice?

Looking for clarity on how it works? Here’s how a company builds and manages its public reserve of Bitcoin:

- Collection of Bitcoin through OTC purchases, mergers, and direct investments by shareholders

- Frequent and transparent audits, often conducted by recognized third parties

- Versatile allocation: liquidity for operational management and holdings in specialized investment vehicles

This model strengthens the entire ecosystem and offers greater liquidity even to traditional markets.

Do you want to invest in the public Bitcoin treasury? Here’s what you can expect

The arrival of new operators on the stock exchange offers various opportunities for both large and small investors:

- Indirect access to professionally managed Bitcoin under the control of regulatory entities

- Possibility to follow the performance and strategies of companies through public financial statements

- Participation in the income derived from innovative cryptocurrency management strategies

A trend already visible in the United States, but that is starting to make waves in Europe and Italy as well.

Concrete innovations: Bitcoin transforms insurance, loans, and traditional services

The financial sector updates itself: today, companies can offer services previously unimaginable thanks to Bitcoin. Examples include:

- Real estate mortgages guaranteed by Bitcoin portfolios

- Rapid personal and business loans, without the bureaucracy of traditional banking channels

- Dynamic and transparent insurance coverage, made possible by blockchain

Developments that lead to a new financial inclusivity and reduce the time to access credit. According to Deloitte, the integration of crypto in insurance and loans is set to grow in the coming years.

Shadows on the market: what are the real challenges for those managing a public Bitcoin treasure?

Not only opportunities: the main issues of the market remain the uncertain regulation, the security of custodians, and the price volatility of Bitcoin. However, many companies are investing in advanced custody solutions and compliance to mitigate risks and gain the trust of the markets.

Italy, still a spectator, observes the developments in the USA and in the Anglo-Saxon area, with growing interest towards possible local applications and partnerships.

A look into the future: Public Bitcoin, beyond speculation

The SPAC merger of Bitcoin Standard Treasury Company is just the beginning. We are facing a new era of strategies, hybrid products, and synergies between crypto and traditional finance. Those who can anticipate the changes — even just by observing and staying informed — will be able to take advantage of a growing market, where the keyword is innovation. What do you think? Are we really at the beginning of the “new Bitcoin Exchange”?

Finley Benson is a tech-savvy writer with a background in blockchain development, Finley explores the latest innovations in Web3, DeFi, and smart contract technologies. His articles blend technical depth with real-world applications.