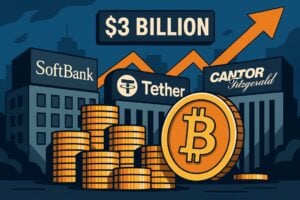

The Japanese giant SoftBank is participating in one of the most daring and innovative initiatives in the history of corporate finance: the creation of a public vehicle worth 3 billion dollars, entirely built around a treasury strategy in Bitcoin. Together with Tether and Cantor Fitzgerald, the initiative aims to redefine the rules of capital management …

SoftBank towards a $3 billion vehicle in Bitcoin: a paradigm shift in corporate finance

The Japanese giant SoftBank is participating in one of the most daring and innovative initiatives in the history of corporate finance: the creation of a public vehicle worth 3 billion dollars, entirely built around a treasury strategy in Bitcoin.

Together with Tether and Cantor Fitzgerald, the initiative aims to redefine the rules of capital management for listed companies.

According to what was reported by Bloomberg, the project will have a one-of-a-kind structure: it will be funded exclusively in cryptocurrency, without any interventions in fiat currencies.

In particular, SoftBank would contribute 900 million dollars, Tether with 1.5 billion, and Bitfinex, Tether’s sister company, with another 600 million dollars.

The vehicle would thus start with an allocation of about 32,000 BTC, an amount that would immediately position it among the top five public entities in the world for the quantity of bitcoin held.

Bitcoin as a balance engine for SoftBank

The proposal represents a strategic turning point that follows the pioneering path undertaken by Strategy (formerly MicroStrategy), the company emblematic of the transformation of Bitcoin into a strategic balance sheet asset.

As highlighted by CEO Phong Le during the MIT Bitcoin Expo, the company has achieved returns superior to those of the main American indices, from the Nasdaq to the S&P 500, and even to bitcoin itself.

The secret? A radically rethought balance sheet structure as a dynamic system to raise capital, invest it in bitcoin, and maintain constant transparency on reserves.

Here we are not talking about speculative operations, but about a structured strategy that allows transforming the company balance sheet into a high-efficiency capital formation tool.

In this perspective, companies that remain anchored to traditional financial models, based on asset defense and reserves in fiat, inevitably prove to be less performing.

Japan has already successfully tested this new financial architecture. In 2024, Metaplanet Inc., a company initially active in the hotel sector and in economic crisis, has completely reintegrated its identity.

Transforming itself into one of the companies with the highest stock performance in the world. How? By fully embracing a strategy based on bitcoin treasury.

Metaplanet did not just purchase criptovalute: it rebuilt its financial structure precisely around them, using bitcoin not only as a reserve asset but as leverage for debt issuance, capital raising, and asset allocation.

Decisive was the BTC yield, or the return on bitcoin reserves in relation to the distributed shares. Already in the first quarter of 2025, Metaplanet achieved a BTC return of 15.3%, setting the target at 35% per quarter.

The market responded positively, valuing the company more based on the performance in bitcoin per share than on earnings per share.

A clear signal indicating how the crypto asset is now perceived as active and programmable capital, and no longer as a simple volatile reserve.

The SoftBank bet: more than symbolism

For a company like SoftBank, with over 32.9 billion dollars in cash and an estimated net worth of around 200 billion dollars, an exposure to bitcoin of 900 million may seem marginal, just 2.7% of the reserves.

However, the symbolic and strategic impact of structuring such an allocation in a public vehicle entirely built on bitcoin is immense.

It would not be, in fact, an ETF or a synthetic fund, but a true operating company native in bitcoin, designed to operate in the public stock markets.

This format makes bitcoin accessible to investors through traditional financial channels, but at the same time creates a direct bridge to financial instruments guaranteed in BTC, expanding the possibilities for capitalization operations and fundraising.

The creation of this vehicle would also meet a specific need of the Japanese market: today, the country indeed lacks a bitcoin spot ETF.

The entry of SoftBank could therefore fill this gap, offering a liquid, institutionalized, and highly visible channel for exposure to bitcoin.

“`html

A new standard for companies

“`

The most powerful signal that would result from the launch of this new vehicle is that bitcoin is no longer to be considered an experimental reserve, but rather a dynamic and strategic asset for building corporate value.

The treasury in bitcoin is no longer a niche for enthusiasts of the crypto sector. It is indeed establishing itself as a structural model for a new generation of public enterprises.

SoftBank, thanks to its financial dimension, international reputation, and the strength of the infrastructure, can be the architect of the next phase of this transformation.

If the operation is completed, it will represent one of the largest treasury investments in bitcoin in corporate history worldwide, by far the most significant ever made in Asia.

What until yesterday seemed like an experiment today becomes programmable capitalism: corporate balance sheets transformed into active tools for development, growth, and innovation. The era of digital treasury has begun, and SoftBank is ready to make it take off.

Finley Benson is a tech-savvy writer with a background in blockchain development, Finley explores the latest innovations in Web3, DeFi, and smart contract technologies. His articles blend technical depth with real-world applications.