Even though it is commonly thought that inflazione del dollaro USA (USD) only has effects in the USA, in reality, it has a global impact, even on Bitcoin. It should be noted, however, that the term “inflazione” in the financial context can be used with two distinct, albeit related, meanings: the increase in consumer prices, …

The inflation of the dollar has global effects, even on Bitcoin

Even though it is commonly thought that inflazione del dollaro USA (USD) only has effects in the USA, in reality, it has a global impact, even on Bitcoin.

It should be noted, however, that the term “inflazione” in the financial context can be used with two distinct, albeit related, meanings: the increase in consumer prices, or the increase in the money supply.

If an increase in the money supply produces price increases, it is not equally true the opposite, because prices can also increase when supply decreases, and not only when demand increases.

The inflation of the dollar as global taxation: should Bitcoin holders tremble?

That an increase in the money supply of USD produces inflation in the USA is a given. However, according to a recent hypothesis, it could actually produce consequences in the rest of the world as well.

This is suggested by the former CTO of Coinbase, Balaji Srinivasan, who on X wrote that if the approximately 6 trillion dollars since 2020 had been distributed only among the 330 million inhabitants of the USA, instead of the over 8 billion inhabitants of planet Earth, it would shift from printing less than $1,000 per person to almost $20,000 per person.

According to Srinivasan, if indeed this enormous and rapid increase in the USD money supply had only affected Americans, their purchasing power would have decreased much more.

The former CTO of Coinbase concludes that “the American Empire implements global taxation through dollar inflation,” and that Trump’s current policy and the so-called MAGA “only hands the world over to China, which is ready to pick up the pieces.”

However, Srinivasan’s hypothesis has not been supported by evidence.

The impact of US dollar inflation on Bitcoin

Bitcoin is a global asset, even if its price trend seems to be mainly linked to the US markets.

Yet, for example, the trading pair BTC/USD on the main American exchange, Coinbase, does not exceed 600 million dollars in daily trading, while on Binance (the main exchange in the world, but which does not operate in the USA) the trading pair BTC/USDT far exceeds one and a half billion dollars.

On the other hand, in the USA there are “only” 330 million inhabitants, while in the rest of the world there are more than 7.7 billion.

Despite this evident disparity, the price of Bitcoin seems to be primarily influenced by the U.S. market.

An explanation for this apparent anomaly could indeed be connected to what Srinivasan claims, namely the fact that the US dollar should actually be considered as a global currency, and not as the specific currency of the United States of America.

Of course, USD is issued and managed by the United States Federal Reserve, but it is widespread around the world, especially in the crypto markets thanks to stablecoins like USDT and USDC.

The true relationship between dollar inflation and the price of Bitcoin

So when discussing the relationship between inflation and Bitcoin, it does not actually refer to the relationship between price increases in a given country and the exchange rate of BTC with the local currency, but it specifically refers to the relationship between changes in the US dollar money supply and the BTC/USD exchange rate.

To tell the truth, this reasoning, which links the trend of Bitcoin’s market value to the inflation of the money supply, and not to the increase in consumer prices, applies to all the currencies of the world, but while for USD it is evident and significant, for other currencies it is often marginal or even irrelevant.

It is not even a coincidence that when the US dollar depreciates against other currencies, that is when the Dollar Index (DXY) falls, the price of Bitcoin tends to rise, even if this means that the other currencies have appreciated against the USD.

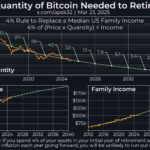

Therefore, the price of Bitcoin tends specifically to be correlated in the long term with changes in the money supply of the US dollar.

Short-term forecasts

Although this may lead one to think that in the long term the market value of Bitcoin could indeed be destined to increase, given that fiat currencies (including USD) always depreciate in the long term, the short-term situation appears different.

After reaching the new all-time high above $109,000 on January 20, 2025, the price of Bitcoin has started a downward phase that may not have concluded yet.

To tell the truth, it might already seem concluded with the rebound on March 11 after falling even below $77,000, but this could be just a temporary illusion.

In fact, there are neither clear signs of a possible trend reversal in the short term, nor others that might lead one to believe that the decline is over.

Indeed, several analysts think that the phase of suffering might also be destined to continue for a while, possibly even into April.

Having said that, however, even a potential drop to 75,000$, or even to 70,000$, might not be able to invalidate the long-term bull trend.

Finley Benson is a tech-savvy writer with a background in blockchain development, Finley explores the latest innovations in Web3, DeFi, and smart contract technologies. His articles blend technical depth with real-world applications.