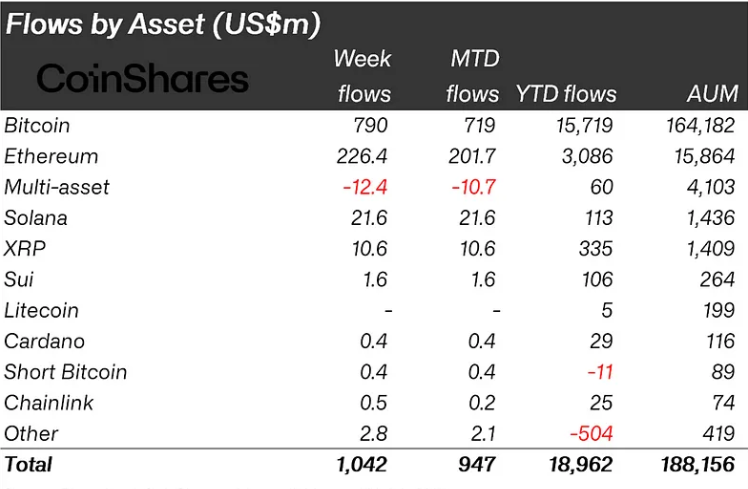

Led by Bitcoin and Ethereum, digital asset investment products marked the twelfth straight week of positive sentiment, according …

Among the most active companies in the sector, Metaplanet has consolidated its presence with the purchase of additional …

In the last week, the news that Bitcoin will become a key asset for the newly founded America …

Geopolitical tensions continue to influence global markets, but their echo is much stronger in the cryptocurrency market. The …

Financial author Robert Kiyosaki has warned of attention-seeking “losers” who are increasingly speculating that Bitcoin will crash but …

Analyst suggests Bitcoin may consolidate before breaking key resistance, setting up for a potential new all-time high. This …

On July 4th, one of the most silent and legendary bitcoin whales made an unexpected move: after 14 …

Largest stablecoin issuer Tether Holdings has entered a Bitcoin mining collaboration with Adecoagro, a major South American agricultural …

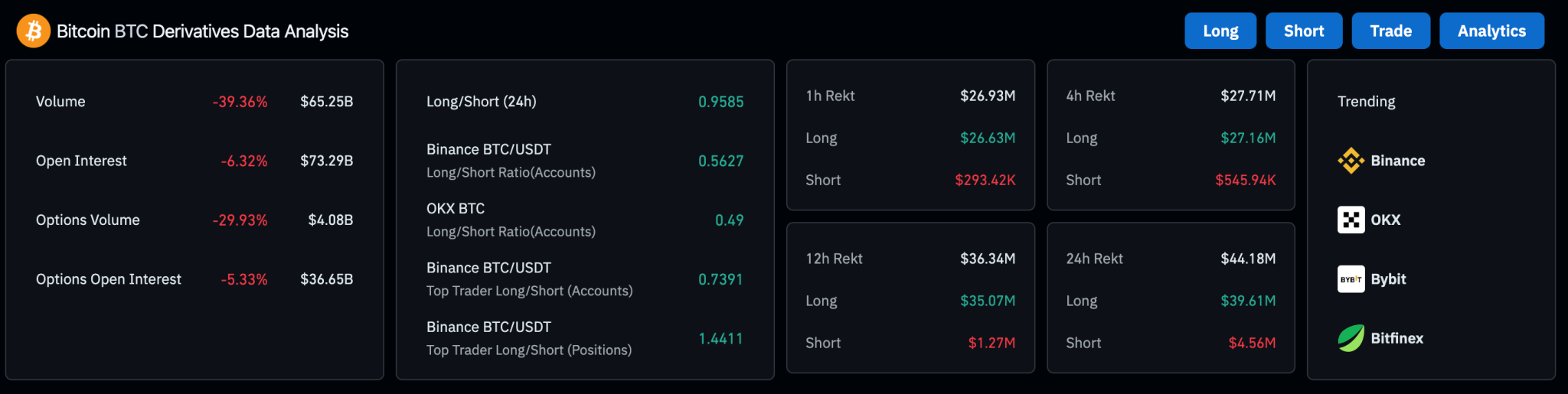

Yesterday, the price of Bitcoin started to rise: at first, it seemed to be just a rebound, but …

Prominent market analyst MichaelXBT predicts Bitcoin could breach long-term resistance, leading to what he calls the "breakout of …

ABOUT

Every Altcoin has a story- We tell it!

Dive into latest trends, insights, and hidden gem in the altcoin universe.

Trending Now

Up to 160–225 billion dollars could flow into Bitcoin in the coming years, driven by the great wealth transfer between generations. A movement of historical significance that is already impacting estate planning and how families and advisors organize digital assets. According to the data collected by our research team between 2023 and 2025, analyzing over …

Amid the latest Bitcoin price struggles, a prominent market analyst has warned of a steeper decline if rejection hits at the $120,000 psychological mark. Technical analyst CasiTrades, who has over a decade of market experience, outlined a setup that could determine whether Bitcoin continues its correction or breaks into new highs. Bitcoin Completes Wave 1 …