Bitcoin is back on the move, climbing dramatically from under $99K to over $108K in just two days. …

A mysterious transfer of 1,140 Bitcoin, equivalent to 121 million dollars, has shaken the crypto market, with the …

Taproot Assets represents the new frontier of the Lightning Network, offering a multi-asset protocol on the Bitcoin mainnet. …

Michael Saylor, executive chairman of Strategy and longtime Bitcoin advocate, addressed the BTC Prague 2025 audience last week …

The Turkish government is preparing to implement new stringent measures to combat money laundering through crypto transactions.In particular, …

Metaplanet has announced a significant investment plan to enhance its Bitcoin accumulation strategy, forecasting a capital injection of …

A top market analyst has identified a recurring pattern of uptrend on the Bitcoin chart, sharing what’s next …

Bitcoin news: DigiAsia Corp, among the leading platforms Fintech-as-a-Service (FaaS) listed on Nasdaq, takes a decisive step in …

Michael Saylor reignites attention on the future of Bitcoin purchases by Strategy, despite the recent legal controversies related …

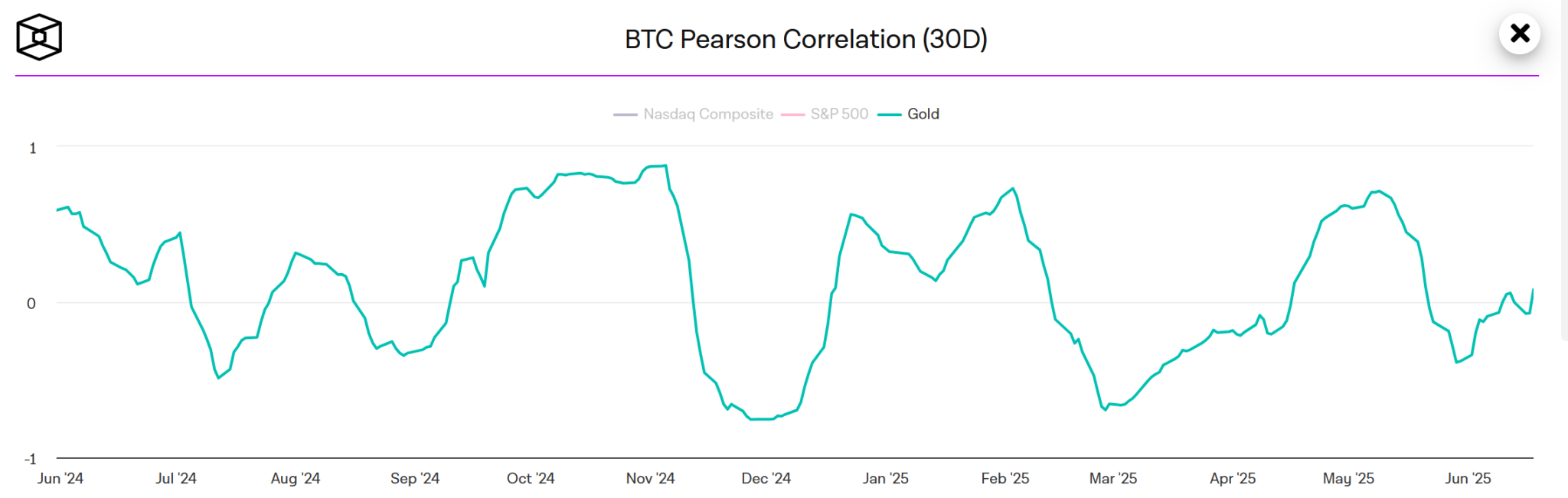

Bitcoin could target a 61% rally to an unprecedented price if it mirrors gold’s performance, as it always …

ABOUT

Every Altcoin has a story- We tell it!

Dive into latest trends, insights, and hidden gem in the altcoin universe.

Trending Now

Up to 160–225 billion dollars could flow into Bitcoin in the coming years, driven by the great wealth transfer between generations. A movement of historical significance that is already impacting estate planning and how families and advisors organize digital assets. According to the data collected by our research team between 2023 and 2025, analyzing over …

Amid the latest Bitcoin price struggles, a prominent market analyst has warned of a steeper decline if rejection hits at the $120,000 psychological mark. Technical analyst CasiTrades, who has over a decade of market experience, outlined a setup that could determine whether Bitcoin continues its correction or breaks into new highs. Bitcoin Completes Wave 1 …