After the establishment of the United States national reserve in Bitcoin by Donald Trump, several US states are …

Some federal tax agents from Brazil (RFB) have discussed the possibility of confiscating Bitcoin (BTC) at airports. These …

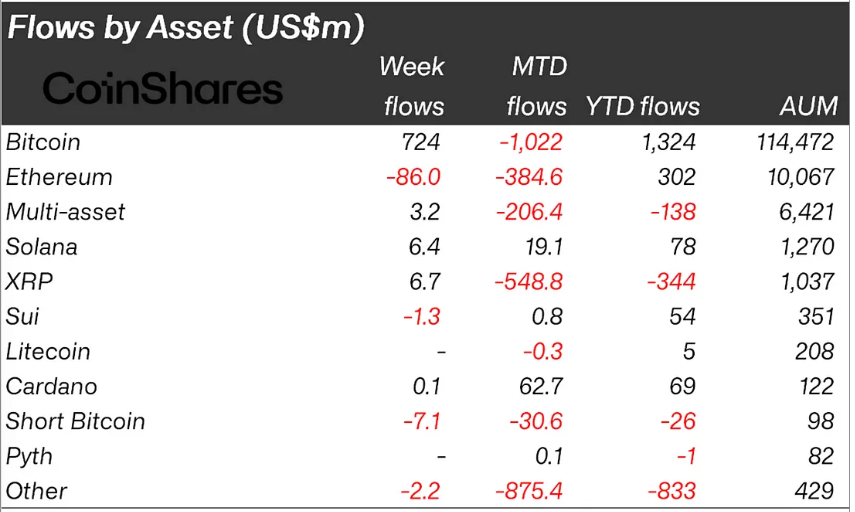

Global crypto funds are again seeing net positive inflows after a record drought, with Bitcoin leading the pack. …

The company Strategy has recently acquired 6,911 Bitcoin for a total value of 584 million dollars, bringing the …

Metaplanet has announced the purchase of an additional 150 Bitcoin (BTC), bringing the total of its reserves to …

A Bloomberg analyst has urged investors to lower their expectations of the Trump administration buying Bitcoin in 2025. …

Metaplanet, the largest Japanese company holding Bitcoin, has announced the appointment of Eric Trump to its new strategic …

Bitcoin Open Interest in the futures market has slumped 35% since the asset's all-time high, as downward pressure …

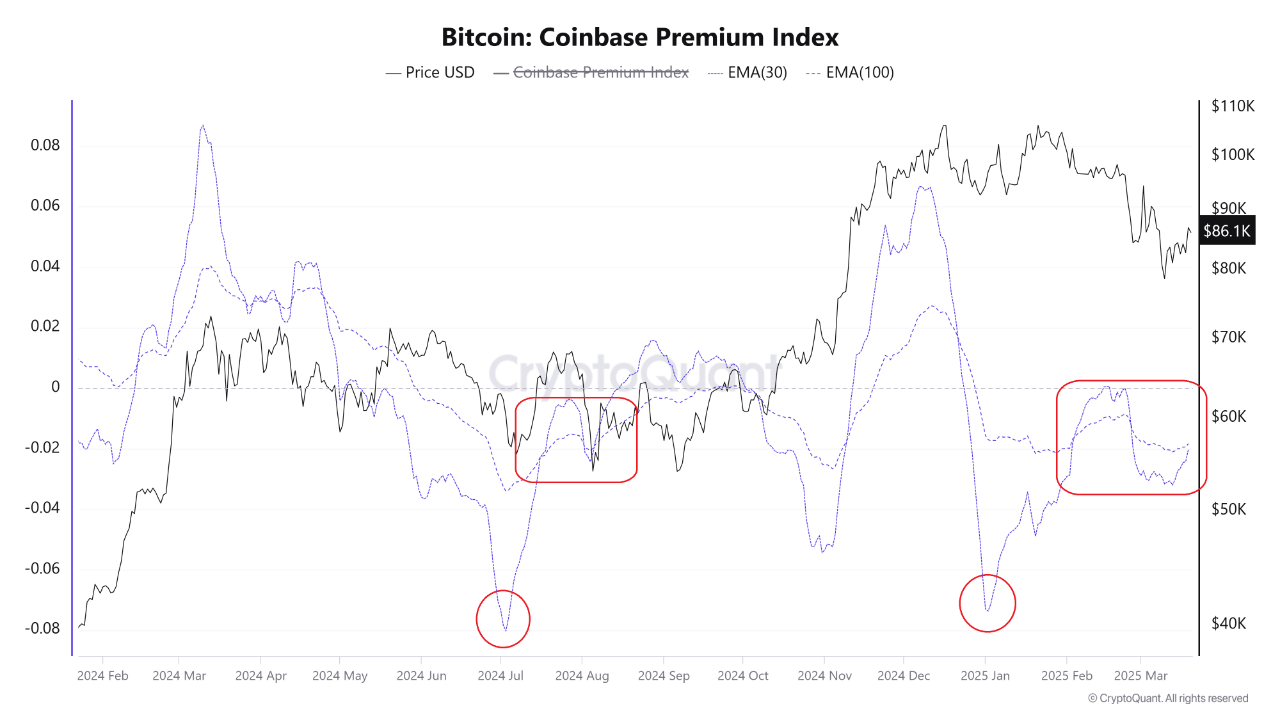

Wells Fargo suggests that Bitcoin may soon see clearer skies, pointing to the relationship between the leading digital …

Hive Digital strengthens its reserve strategy in Bitcoin to reduce dependence on debt and equity dilution. The company …

ABOUT

Every Altcoin has a story- We tell it!

Dive into latest trends, insights, and hidden gem in the altcoin universe.

Trending Now

The first half of 2025 marked a pivotal transition in the crypto derivatives landscape, with institutional capital driving significant changes in market structure. According to CoinGlass’s H1 2025 report, the surge in demand for regulated products and robust inflows into spot ETFs have redefined the Bitcoin and Ethereum markets. CME Leads Bitcoin Futures In particular, …

In the first half of 2025, Bitcoin solidified its transformation from a speculative instrument to a true macro‑asset of institutional allocation. The growing demand from funds, banks, and professional investors pushed its capitalization and dominance to the highest levels of the past four years, confirming the centrality of BTC in the alternative investment landscape. This …