Bakkt, back in 2018, was the first traditional financial company to want to offer derivatives on the Stock …

Futures interest in Bitcoin, the largest cryptocurrency by market cap, has rebounded considerably, with Ethereum and Solana derivative …

Michael Saylor continues to strengthen his company’s presence in the Bitcoin market with a new strategic initiative: the …

Yesterday, Bitfinex released its latest Alpha report dedicated to the recent retracement of the price of Bitcoin. The …

Peter Schiff, renowned Bitcoin skeptic and chief economist, recently tweeted his concerns over the state of the financial …

These days, there are many forecasts circulating about the trend of Bitcoin‘s price, but they are very conflicting. …

According to the latest available data, North Korea is the fifth country in the world by number of …

The Brazil National Congress has received a bill prompting the legalization of salary and remunerations in Bitcoin and …

Bitcoin price may be on the cusp of a devastating collapse, according to Bloomberg Intelligence Senior Commodity Strategist …

The financial market sees a new investment tool with the launch of the BMAX ETF by REX Shares. …

ABOUT

Every Altcoin has a story- We tell it!

Dive into latest trends, insights, and hidden gem in the altcoin universe.

Trending Now

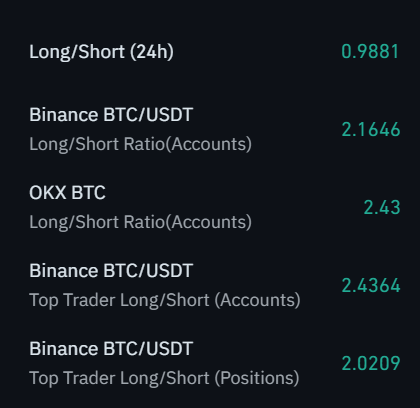

The first half of 2025 marked a pivotal transition in the crypto derivatives landscape, with institutional capital driving significant changes in market structure. According to CoinGlass’s H1 2025 report, the surge in demand for regulated products and robust inflows into spot ETFs have redefined the Bitcoin and Ethereum markets. CME Leads Bitcoin Futures In particular, …

In the first half of 2025, Bitcoin solidified its transformation from a speculative instrument to a true macro‑asset of institutional allocation. The growing demand from funds, banks, and professional investors pushed its capitalization and dominance to the highest levels of the past four years, confirming the centrality of BTC in the alternative investment landscape. This …